UNL Seeking Beta Testers for New Online Agricultural Budget Calculator

December 4, 2020

The Department of Agricultural Economics is preparing to launch an online Agricultural Budget Calculator (ABC) tool and is looking for beta test participants to use the program, report any issues, and provide feedback prior to the public launch.

Register for Annual 4-state Crop Insurance Webinar by Dec. 7

December 3, 2020

An annual four-state crop insurance workshop for agricultural professionals will be presented in a series of three webinars on Dec. 8, between 10 a.m. and 6 p.m. Central time. The program will offer information on designing risk management plans and providing risk management advice to clients.

Free December Webinars: Farm Tax Law Changes and Farm Program and Policy Update

December 3, 2020

The Department of Agricultural Economics’ Farm and Ranch Management team is presenting two free webinars focusing on tax law changes for 2020 and an update on farm program and ag policy in light of a new administration in Washington.

Eighty-three 2021 UNL Crop Budgets Available

December 3, 2020

Updated annually, and available in both PDF and Excel formats, these budgets are a valuable resource to Nebraska producers for managing the financial side of their crop production operation.

Women Managing Ag Land Conference, Now Virtual, is Dec. 2

November 19, 2020

The upcoming Women Managing Ag Land Conference will now be a be completely virtual experience. The event is still set for Dec. 2, from 11:30 a.m. to 2:30 p.m. Central Time.

Free Farm and Ag Law Clinics Set for December

November 19, 2020

Free legal and financial clinics are being offered for farmers and ranchers across the state in December 2020. The clinics are one-on-one meetings with an agricultural law attorney and an agricultural financial counselor. These are not group sessions, and they are confidential.

Cornhusker Economics: Tax Planning 2020

November 19, 2020

With harvest wrapping up or complete, it is time to finish the last bits of 2020 operation tasks. Many of these tasks are part of tax planning. This article is a brief summary of some of the topics to discuss with your tax preparer before year-end.

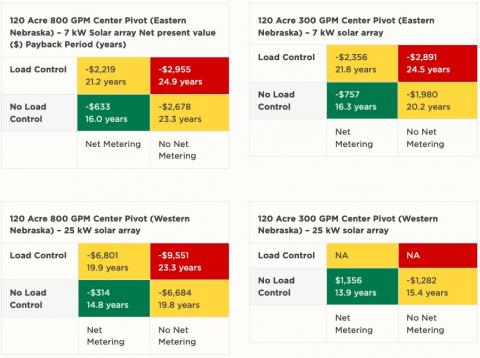

Solar Power and Center Pivots - Part 2: Economic Modeling

November 6, 2020

The decision whether or not to invest in solar is an individual decision. The conclusion here is not whether to invest or not, but rather which center pivot scenarios are better suited for better return on investment and which pivots a farmer may want to target first if considering solar installations.