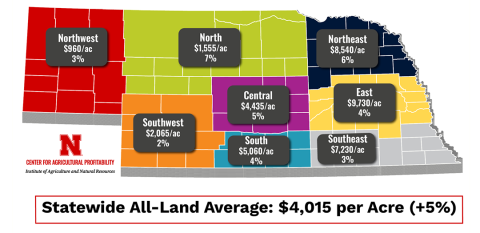

Nebraska Ag Land Values Up 5%, Cash Rents Moderating According to 2024 Farm Real Estate Report

July 25, 2024

In the final report for 2024, Center of Agricultural Profitability experts detailed Nebraska's fifth consecutive year of rising ag land values.

Ag Land Management Webinar to Offer Latest on Cash Rents, Lease Arrangements for 2024

July 23, 2024

The August webinar will cover recent findings from the 2024 Nebraska Farm Real Estate Report and conclude with a live "Ask the Experts" session.

Cultivate Your Legacy: Nebraska Department of Ag Programs

July 11, 2024

A new webinar shares details on NDA's beginning farmer tax credit and the farm mediation programs.

Nebraska Researchers Contribute to Study on Cover Crops in Livestock Operations

July 11, 2024

The research team's work underscores the potential for significant expansion in the use of cover crops, particularly in areas where integration with livestock is feasible.

2024 Nebraska Custom Rates: What to Charge?

June 20, 2024

This article reviews the 2024 Nebraska Custom Rates Report, a comprehensive resource that serves as an essential guide for those offering and seeking custom agricultural services.

Parsons Selected as New Center for Agricultural Profitability Director

June 13, 2024

Parsons has been with the Center for Agricultural Profitability since 2014, serving as an associate professor and extension program area leader.

Ag Land Management Webinar to Offer Latest On Cash Rents, Changing Commodity Prices For 2024

May 8, 2024

The May 20 webinar will examine the latest average cash rental rates in the state, how to adjust rental rates with regard to current commodity prices, and will include a Q&A session for participants.

Nebraska Climate Plan Webinar

April 26, 2024

UNL Ag Law Specialist Dave Aiken breaks down the Nebraska climate action plan, focusing on what the plan proposes to do to reduce agricultural climate pollution emissions in Nebraska.