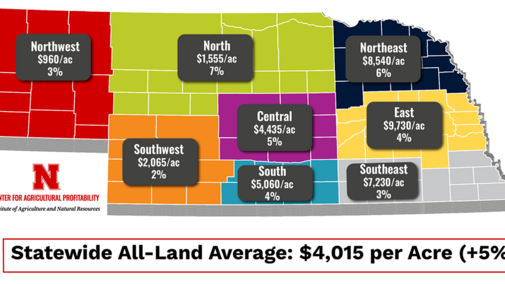

For the fifth consecutive year, the average all-land value of agricultural land in Nebraska increased, reaching $4,015 per acre in the 12-month period ending Feb. 1, 2024, according to the final report from the University of Nebraska–Lincoln’s 2023-2024 Farm Real Estate Market Survey.

This marks a 5% increase over the prior year and is the highest non-inflation-adjusted statewide land value in the history of the survey. Based on 2024 market values, Nebraska's estimated total value of agricultural land and buildings rose to approximately $179.2 billion.

The survey’s final report was published June 28 by the university’s Center for Agricultural Profitability, which is based in the Department of Agricultural Economics. It provides current point-in-time estimates of agricultural land values and cash rental rates, broken down regionally across a variety of land types and classes.

Purchases for farm expansion, current livestock prices, and 1031 tax exchanges were identified in the report as the major economic forces that guided the higher market value of land across the state. According to survey results, the amount of land offerings for sale and non-farmer investor interest in land also contributed to higher values.

Inflation pressure continuing from the prior year led many operations to consider investing in assets like land or agricultural equipment, according to Jim Jansen, an agricultural economist with Nebraska Extension. He co-authored the survey and report with Jeffrey Stokes, a professor in the Department of Agricultural Economics.

“Federal Reserve policies to combat inflation have increased borrowing and financing expenses. Higher interest rates influence the cost of short-term lending for annual operating loans and long-term purchases such as farm real estate,” Jansen said. “Rising interest rates might affect the agricultural real estate market without additional profitability to offset the increasing financing expenses.”

Continue this article on the Center for Agricultural Profitability.