Harvest Operations: Own It or Hire It?

September 22, 2023

A review of custom rates in 2022 and how to use the Ag Budget Calculator to determine what custom operators may be charging this year.

'Mending the Stress Fence' Virtual Programs Set for Aug. 29 and Sept. 5

August 25, 2023

The upcoming webinars will provide information on identifying common stressors, recognizing stress symptoms, and managing stress.

Technology Use Growing on Nebraska Farms and Ranches

August 24, 2023

A recent USDA NASS survey on technology use in agriculture revealed some interesting trends for the industry — in particular, Nebraska's above-average rating on ownership and use of technology.

Ag Law in the U.S. Supreme Court

August 11, 2023

UNL Professor and Agricultural/Water Law Specialist Dave Aiken examines three 2023 decisions by the U.S. Supreme Court that affect the ag industry.

Preparing for Farm and Ranch Succession: How You Select a Lawyer

August 10, 2023

Insights on how to prepare for a meeting with an attorney, including questions that can help producers decide who will best represent their family's interests.

Nebraska Approves Pass-through Entity Tax Bill

August 4, 2023

Whether or not the pass-through entity tax bill could benefit you will depend on your profitability level, current structure, operation size, and other factors. Read the Center for Ag Profitability's recent analysis to make an informed decision about this new tax option.

Tracking Cost of Production During the Growing Season Using the Ag Budget Calculator (ABC) Program

July 28, 2023

In these workshops, ag finance professionals will guide participants through the process of creating customized crop budgets for owned and rented farms, determining costs on a per-farm or field basis, and more.

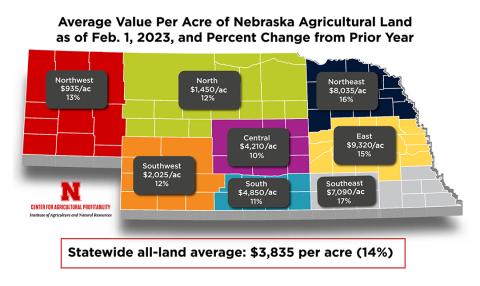

Land Values and Cash Rents: 2023 Nebraska Farm Real Estate Update

July 28, 2023

Center for Ag Profitability experts discuss findings from the final 2023 Nebraska Farm Real Estate Market Survey report, including average reported land values and cash rental rates for different classes and types of ag land across the state.