Ag Land Management Webinar to Offer Latest On Cash Rents, Changing Commodity Prices For 2024

May 8, 2024

The May 20 webinar will examine the latest average cash rental rates in the state, how to adjust rental rates with regard to current commodity prices, and will include a Q&A session for participants.

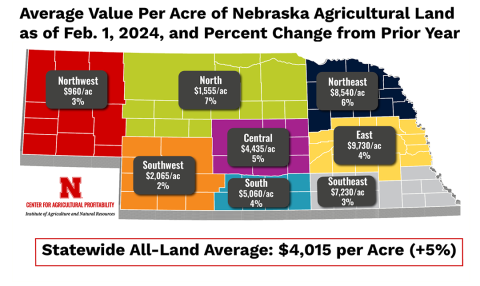

Nebraska Ag Land Values Up 5%, According to 2024 Farm Real Estate Survey

March 13, 2024

The market value of agricultural land in Nebraska increased by 5% over the prior year — the third consecutive year of ag land value increases for the state.

Nebraska Farm Numbers Lower in 2023

February 27, 2024

Nebraska lost 100 farms and ranches throughout 2023, according to USDA NASS's latest report.

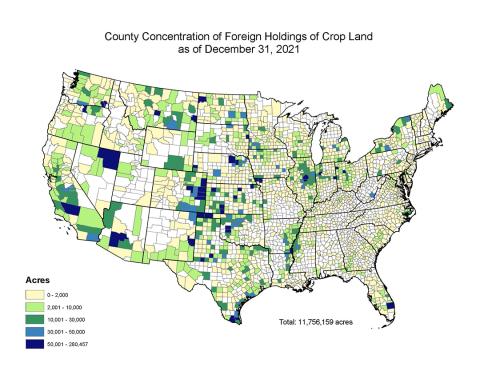

Foreign Land Ownership Bills Introduced in Nebraska Legislature

February 15, 2024

Dave Aiken, professor and extension agricultural law specialist, discusses two new Nebraska legislative bills aimed at restricting alien land ownership.

UNL Ag Land Management Webinar to Offer Updates on Cash Rents, Farm Programs, Leasing

November 14, 2023

The final Land Management Quarterly webinar for 2023 will cover recent findings from the USDA NASS county-level cash rent survey and trends in farm programs influencing operations across the state.

USDA Reports on 2023 Nebraska Land Values and County-level Cash Rent Estimates

October 18, 2023

According to USDA estimates, Kansas, New Jersey and Nebraska have experienced the highest increases in U.S. cropland value this year.

Webinar: Foreign Investment in the U.S. and Ag Land Ownership Restrictions

October 12, 2023

Center for Ag Profitability experts examine the current state and implications of foreign investment in agricultural land in the U.S. and Nebraska.

Are You a Farmer or Rancher Over 18? It’s Time for an Estate Plan

October 12, 2023

Often, the risk of failure for a farm caused by the unexpected death or disability of a young person is much greater than the loss of an older member. In this article, learn more about the key components of creating an estate plan for young producers.