Running Your Business: Employment-at-Will

October 8, 2018

Nebraska is an "employment-at-will" state; however, there are instances when an employee's dismissal could be illegal. This article is one in a series on running your own business.

Farm/Ranch Transition Workshops: When You're Not in Control

September 28, 2018

A new series of Nebraska Extension farm/ranch transition workshops is designed for the "sandwich generation," the one falling between retiring grandparents and the grandchildren who may or may not be interested in returning to the operation. The workshops will cover family communication and financial and legal aspects.

Gold Star Negotiations: BANTA

September 26, 2018

When negotiating, knowing when and under what conditions you should walk away is critical to your success. Here's how to use BANTA the next time you negotiate.

Farm Finance and Ag Law Clinics this October

September 20, 2018

Openings are available for one-on-one, confidential farm finance and ag law consultations being conducted across the state.

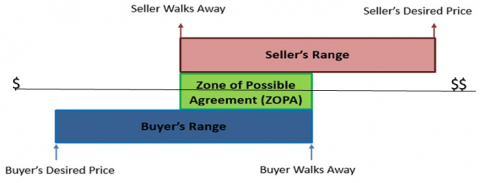

Gold Star Negotiations: ZOPA

September 18, 2018

When negotiating, identifying the Zone of Possible Agreement (ZOPA) can help you more realistically find a "middle ground" that creates a win-win for both negotiators.

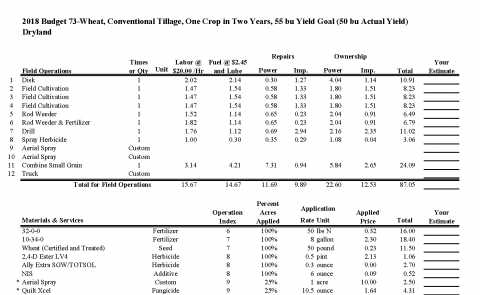

Using Wheat Crop Budgets to Assist Decision Making

August 29, 2018

Nebraska Extension has published seven wheat production budgets to help growers identify total costs under different scenarios as well as potential opportunities for trimming costs.

Will a Date-Driven Winter Wheat Marketing Plan Improve Your Revenue?

August 28, 2018

This article evaluates various date-driven winter wheat marketing strategies, using 20 years of prices for Kimball, Nebraska. It compares each year’s average harvest price and the probability of the average price of a strategy being higher than the cash price at harvest.

Excel® Pro Tip: Sumif

August 23, 2018

The "Sumif" app in Excel may be just what you need to sum data from individual fields within a category. Rather than restructure your data, this tool allows for customization.