Tax Options Amid Drought Conditions

September 29, 2022

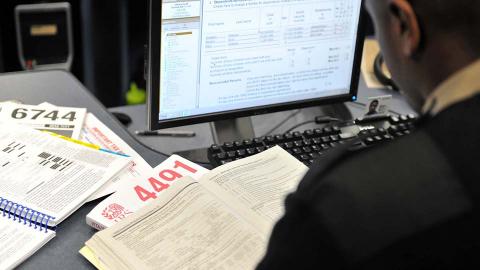

Nebraska Farm Business, Inc. Director Tina Barrett reviews factors that farmers and ranchers should take into consideration before electing tax deferrals for drought-impacted crops and livestock.

Nebraska Inheritance Tax Update

March 8, 2022

Dave Aiken, UNL Extension water law and agricultural law specialist, discusses how LB310 will reduce most inheritance taxes beginning in 2023.

Webinar to Cover Finding a Tax Advisor for Farm and Ranch Businesses

December 21, 2021

With evolving tax laws and ever-increasing complexity, it’s more important than ever to find the right tax advisor that understands the special rules to apply to farmers and ranchers to help these businesses stay in compliance and minimize tax obligations.

The Nebraska Microenterprise Tax Credit

November 3, 2021

Learn more about farmers' eligibility requirements for the Nebraska Microenterprise Tax Credit, a refundable credit given to individuals operating small businesses who demonstrate growth in their business.

2021 Federal Estate and Transfer Tax Law Proposals

September 2, 2021

Tina Barrett, director of Nebraska Farm Business, Inc., reviews the federal estate and transfer tax law proposals submitted to Congress this year that would dramatically change the tax implications for many farm businesses.

Free December Webinars: Farm Tax Law Changes and Farm Program and Policy Update

December 3, 2020

The Department of Agricultural Economics’ Farm and Ranch Management team is presenting two free webinars focusing on tax law changes for 2020 and an update on farm program and ag policy in light of a new administration in Washington.

Cornhusker Economics: Tax Planning 2020

November 19, 2020

With harvest wrapping up or complete, it is time to finish the last bits of 2020 operation tasks. Many of these tasks are part of tax planning. This article is a brief summary of some of the topics to discuss with your tax preparer before year-end.

Understanding and Applying Casualty Losses

June 3, 2019

Casualty losses are an area of the tax code that we thankfully don’t have to deal with very often. However, when they do occur, they can be a major event in the life of a farming operation. Here are some things to consider and do now before tax time rolls around.