Ideas for Estate and Transition Planning: Gifting

April 24, 2024

Gifting assets, such as equipment, livestock, land, or shares of an entity, is one of several ways to compensate family members in an operation, but it requires careful consideration of the guidelines.

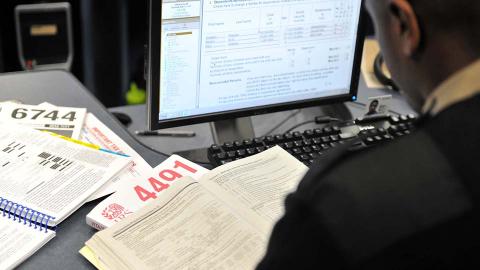

2023 Income Tax Updates for Farmers and Ranchers

December 1, 2023

This webinar reviews 2023 tax considerations for ag producers, including crop insurance, deferral options for livestock sales, potential law changes and more.

What is IRS Section 180 and How Does it Work?

November 16, 2023

With recent land purchases, some producers are asking questions to learn more about IRS Section 180 and how it may provide tax deductions in the year of purchase.

Ag Law in the U.S. Supreme Court

August 11, 2023

UNL Professor and Agricultural/Water Law Specialist Dave Aiken examines three 2023 decisions by the U.S. Supreme Court that affect the ag industry.

Nebraska Inheritance Tax Update

March 8, 2022

Dave Aiken, UNL Extension water law and agricultural law specialist, discusses how LB310 will reduce most inheritance taxes beginning in 2023.

Cornhusker Economics: 2020 Nebraska Property Tax Changes

August 27, 2020

The Nebraska Unicameral enacted significant property tax relief legislation in the closing days of the 2020 legislative session. The compromise establishes a refundable state income tax credit of an estimated 6% of the property taxes paid for local schools (excluding property taxes for school bonds and school budget overrides).

Applying for Reduced Valuation of Damaged Property

June 14, 2019

A Q&A on the process of applying to have your property value reduced if you suffered significant 2019 flood damage.

New Law Allows Lower Taxes for Flood-Damaged Property

June 5, 2019

A new Nebraska law provides that property owners who suffered significant flood damage can apply to have their 2019 property taxes lowered. Damage must be reported on a new state form by July 15.