USDA Announces $22 Million to Support Underserved and Veteran Farmers and Ranchers

June 7, 2024

With USDA's 2501 Program funding, organizations conduct education, training, farming demos, and ag conferences to help underserved and veteran producers operate successful farms.

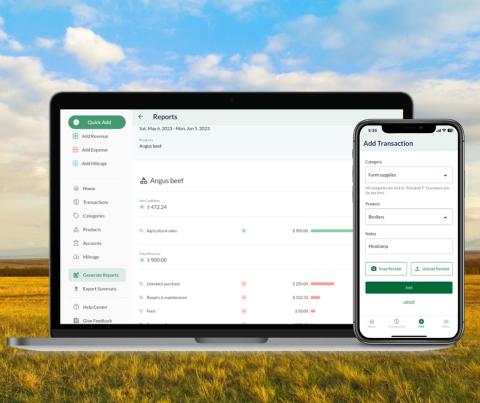

USDA Partners with FarmRaise on Financial Tools and Resources for Agricultural Producers

June 7, 2024

A newly launched online tool assists livestock producers who suffered losses from severe weather, providing guidance on required loss documentation and a portal to submit their information to FSA county offices.

The Basics of Loans for Farmers and Ranchers

June 6, 2024

Extension Agricultural Economist Jessica Groskopf reviews basic information about loans, such as the difference between secured and unsecured loans, and what financial documents to prepare for a lender.

USDA to Host Beginning Farming and Ranching Webinar Series for Service Members, Veterans

April 16, 2024

This webinar series will provide service members, veterans and military spouses with critical USDA Beginning Farming and Ranching Program information that will better position attendees to enter ag careers.

Farmers, Ranchers Now Can Make USDA Farm Loan Payments Online

February 16, 2024

To better assist producers during seasons of limited free time, such as planting and harvest, farm loan payments can now be made at the borrower’s convenience, on their schedule.

USDA Provides $208 Million to Help Prevent Guaranteed Borrower Foreclosure, Assist Emergency Loan Borrowers

December 15, 2023

Borrowers can submit requests in person at their local FSA office or via the assistance portals on farmers.gov by Dec. 31, 2023.

USDA November 2023 Lending Rates for Agricultural Producers

November 17, 2023

USDA FSA's website features the Loan Assistance Tool, an interactive online, step-by-step guide that assists producers through the farm loan process.

CAP Launches New Loan Payment Calculator Tool

June 15, 2023

The new web-based calculator allows users to estimate a loan repayment schedule for a new loan and compare different loan terms, such as changes in the amount of the down payment, annual interest rates, or loan length.