2017 Farm Real Estate Report Details Price Decline

June 30, 2017

The 2017 Nebraska Farm Real Estate Report released today estimates total value of agricultural land and buildings in Nebraska fell to approximately $127.7 billion, down $5.6 billion from 2016. In the all-land category the state ag real estate average value was $2,820 per acre or about 9% less than the prior year’s value.

Multi-State Research Looks at Means for Optimizing Inputs to Enhance Profits

April 21, 2017

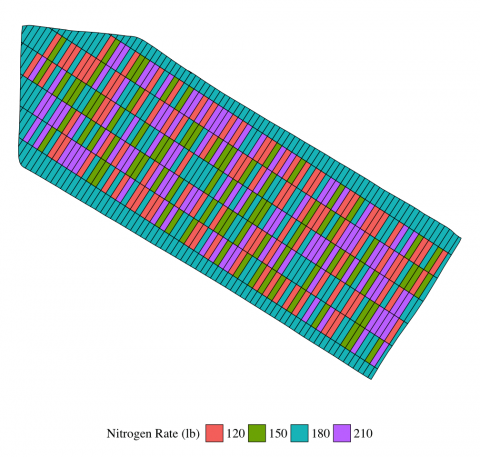

Six researchers at the University of Nebraska-Lincoln are working on the USDA-NIFA-funded Data Intensive Farm Management (DIFM) project. DIFM is based at the University of Illinois, and also involves the Universities of Kentucky, Massachusetts, Maryland, and Illinois State. The overarching goal of the project is to collect production data after conducting large-scale, on-farm randomized input use field trials, and then using the information to inform growers of optimal input use practices to enhance their profits.

Costs of Reducing Potential Nitrogen Pollution in Wheat Production

March 23, 2017

Understanding the influence of variable rate nitrogen technology in other areas can help inform Nebraska producers.

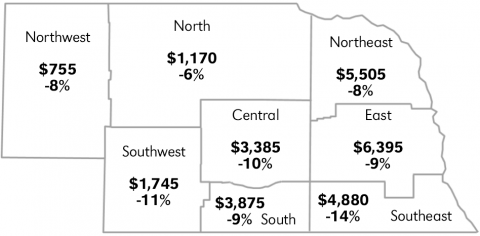

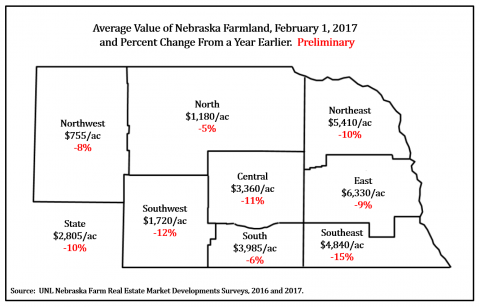

Report: Agricultural Land Values Decline an Average of 10%

March 15, 2017

Preliminary findings from the 2017 Nebraska Farm Real Estate Market Survey conducted by the University of Nebraska–Lincoln indicate that as of February 1, 2017, farmland values declined by about 10% over the prior 12-month period to $2,805 per acre. This marks the third consecutive year of decline. Farmland value peaked in 2014 at $3,315 per acre.

Q&A on the IRS Portability Rule

March 1, 2017

A 2013 tax law change–the portability rule–can simplify farm and ranch estate planning. Farm and ranch families still need to do estate planning to develop and implement farm or ranch business transition plans so that the farm or ranch can continue to be successfully operated by the next generation. This Q&A addresses a number of questions.