Extended Tax Filing Deadline for Farmers and Ranchers

March 8, 2019

This week the IRS announced in Notice 2019-17 an extension to the March 1 deadline for farmers who did not make estimated tax payments by January 15, 2019.

Ag Accounting: The Ins and Outs of Prepaid Expenses

November 12, 2018

Are you considering some late 2018 purchases? Three factors can help you and your tax preparer determine whether they meet the Internal Revenue Service requirements for a prepaid expense.

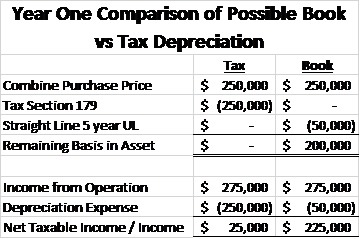

Depreciation — What It Is and How To Use It

August 27, 2018

When and how should you use cost depreciation and when is better to use match depreciation? Each method offers benefits and can help guide decision-making.

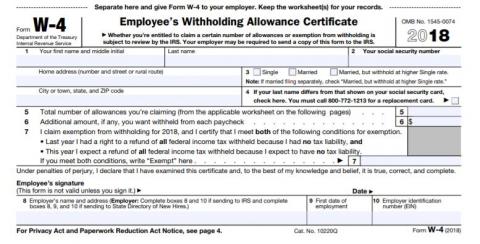

Accounting for Agriculture: Federal Withholding after New Tax Bill

July 11, 2018

With the higher standard deduction and changes in child credits in the new US tax code, taxpayers may need to reconsider how much to withhold for federal taxes in each pay period. Here are information and a tool to help you assess your situation.

Trading Equipment Without Like Kind Exchange

May 22, 2018

Learn how the new federal tax law affects depreciation and basis with new ag equipment purchases. This is one in a series of articles on accounting considerations for ag operations.

Accounting for Agriculture: Who’s a “Related Person”?

May 14, 2018

Understanding the IRS definition of family and its implications for your taxes is important when doing business with "related persons." This is one in a series of articles on Accounting for Agriculture.

Accounting for Agriculture: Personal Property Tax Relief Act

March 5, 2018

With new changes in tax laws and likely more on the way, if you have tangible property in several districts, consider this option for taking more than one personal property tax exemption. With a little more paperwork, you can keep more of your income on the farm or ranch.

Accounting for Agriculture: Using Constructive Receipts

February 27, 2018

Constructive receipts, as provided by US Internal Revenue Service code, provide a means for time-sensitive accounting to address transactions crossing over two record-keeping periods. Here's how to correctly use this accounting option.