The following article is part of a series on Accounting for Agriculture.

In the past you probably did not give it much thought. Call the local dealership, buy the new tractor you had your eye on, trade in your old tractor, and tell the accountant what you did.

The 2017 Tax Cuts and Jobs Act has changed that process just a bit. The change comes into play when you talk with your accountant. Before, the new tractor was added to the depreciation schedule with a basis of cash paid plus the basis of the old. Now, under the new law the new tractor is added to the depreciation schedule with a basis of cash paid plus trade-in value of the old tractor. So what is the difference? Let’s walk through it with some numbers.

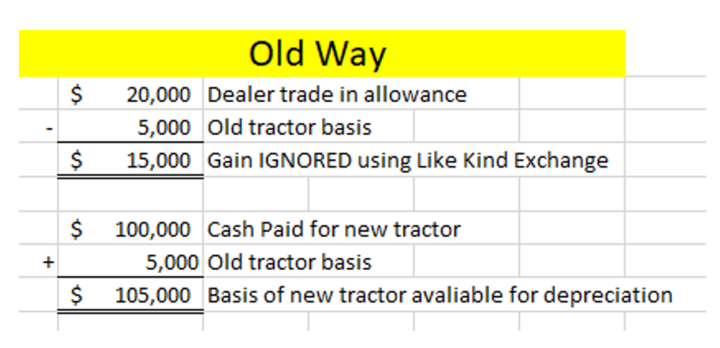

Old Accounting With the “Like Kind Exchange”

For this example, let’s look at buying a new tractor and trading in your old tractor. The new tractor being purchased was negotiated to have a purchase price of $120,000. The dealer has agreed to allow $20,000 on the tractor you want to trade in. On your depreciation schedule the old tractor had $5,000 of basis left on it.

Starting from the top with the old tractor, there would be a gain on sale of $15,000 ($20,000 trade-in value minus $5,000 basis). With the old Like Kind Exchange rule that was ignored. The new tractor was put on the depreciation schedule with a basis of $105,000 ($100,000 cash plus $5,000 old tractor basis). That $105,000 would be available to depreciate.

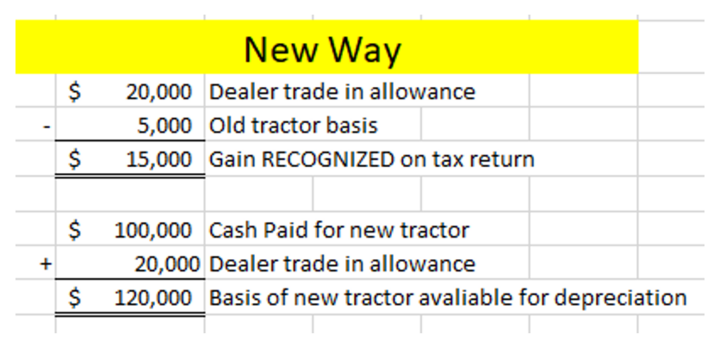

New Accounting Without the “Like Kind Exchange”

Now let’s look at the same situation using the new tax law, starting with the old tractor. Without Like Kind Exchange the $15,000 of gain is going to have to be recognized on the tax return.

The new tractor will be recorded on the depreciation schedule at the full purchase price. In this example that would be $120,000 ($100,000 cash plus $20,000 trade-in). That $120,000 would be available for Section 179, bonus, or regular depreciation.

The Idea Behind The Change

The end result is a recognized gain/loss on the old asset with depreciable basis of the new asset for the full purchase price. The Tax Cut and Jobs Act implemented some changes to help level out the process. In exchange for requiring the recognition of the gain/loss, the new tax bill provides the ability to take more depreciation faster.

The first change is with Section 179. The new tax bill increased the S179 deduction to $1 million with a phase-out threshold amount of $2.5 million. The second change is with Bonus Depreciation. Bonus Depreciation is now available for new and used assets with a depreciable life of 20 years or less. The Bonus Depreciation will also be available through 2022 at 100%, and will then begin to drop 20% each year until it reaches 0 after 2026.

In short for the first few years you will have unlimited depreciation capabilities given the bonus depreciation has no cap.

What About Local Personal Property?

As I have talked about this change in meetings, participants have been quick to pick up on possible local tax implications.

Nebraska calculates basis of personal property assets on an adjusted federal income tax basis. The adjustment is the basis on the federal income tax return increased by the amount of the depreciation, amortization, or deduction under Section 179 of the Internal Revenue Code. To read more on Nebraska personal property see the Nebraska Department of Revenue Information Guide. Another helpful resource is the Nebraska Net Book Value form for Personal Property Returns.