New Program Aims to Help Socially Disadvantaged Ag Producers Access Capital

February 14, 2024

The program will assist underserved farmers and ranchers with finding affordable funding sources to start and grow their business.

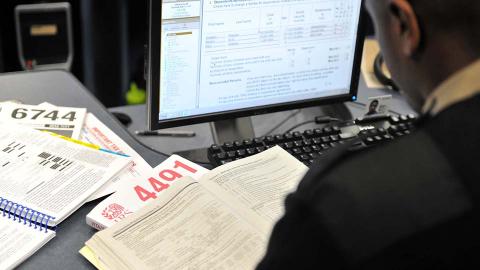

One-Participant 401(k): Saving for Retirement and Reducing Taxes

January 31, 2024

Insights on saving for retirement and reducing tax liability for self-employed farmers and ranchers.

One-Participant 401(k) as a Tool for Farmers and Ranchers

January 31, 2024

Center for Ag Profitability experts review features of the One-Participant 401(k), which helps self-employed individuals and their spouses save money for retirement and reduce taxable income.

Free Farm and Ag Law Clinics Set for February 2024

January 22, 2024

February's clinics will be located in Fairbury, Norfolk, Stuart and Greeley.

Nebraska Extension to Host Grain Marketing Workshops in Crawford, Oshkosh

January 18, 2024

Real audio and video examples of grain market analysts will be used during the workshops to help producers decode market lingo and hone their marketing skills.

Registration is Open for the Annual Local Food and Healthy Farms Conference

January 4, 2024

This year's conference features more than 30 sessions on agricultural and local food systems, including farm financial and transition planning, farm skills, field crops, livestock, farm and food policy, and more.

Free Farm and Ag Law Clinics Set for January 2024

December 19, 2023

Nebraskans can attend a free, in-person farm and ag law clinic in January 2024, or call to arrange a virtual/phone appointment.

2023 Income Tax Updates for Farmers and Ranchers

December 1, 2023

This webinar reviews 2023 tax considerations for ag producers, including crop insurance, deferral options for livestock sales, potential law changes and more.