Overview of Tax Law Changes for Ag Operations

January 11, 2018

The author reviews a number of changes introduced by the 2017 Tax Relief Act and briefly notes their possible effect on farm and ranch operations.

Tax Law Update: Elimination of 1031 Exchanges for Personal Property

January 10, 2018

One outcome of the 2017 Tax Relief Act was the elimination of personal property under the rules of Section 1031. This change will affect record keeping for ag operations and may have a significant impact on many farmer's tax returns.

Effects of Proposed 2017 Tax Reform on Farmers

October 19, 2017

It looks more likely each day that Congress will pass tax reform in the near future. This article looks at how the tax reform changes proposed by President Trump would impact farmers and ranchers. The main goals — to reduce taxes for families and businesses and to simplify the tax code — generally would benefit farmers.

Farm Finance Averages Show Some Light, Despite Concerning Ag Debt

May 3, 2017

Nebraska Farm Business, Inc. recently completed its financial averages for 2016. These averages represent producers across the state who participate in this financial analysis program. Nebraska Farm Business Inc. provides producers with a comprehensive analysis of the financial health of their business, including their accrual basis net farm income (the true earnings of the business), an earned net worth change, cost of production, 21 financial ratios, and more. Each year the data collected from these farms’ records is averaged to provide participants with information to benchmark their operations. Taking a closer look at these averages also indicates shifting trends across these farms and ranches.

Caution for Farm Equipment Leases

March 23, 2017

Many factors in the current agricultural economy are leading producers to consider a lease arrangement of new capital purchases instead of an outright purchase. When considering this option, it’s important to consider both the pros and cons as well as possible effects on your tax return.

Giving Your Farm a Financial Tune-Up

February 21, 2017

It's common for producers to take their tractors and combines into the shop on an annual basis for a tune-up, but it seems less common for them to take time for a financial tune-up. While the equipment is worth a lot of money, the financial health of your business could be worth even more. This story outlines four steps to help you take stock of your farm or ranch finances and use them for informed decision making.

Preparing for Farm Loan Renewal Time

January 10, 2017

Shortly before Christmas, I was watching a Christmas movie with my family about a farm family who was in jeopardy of losing the operation if they didn’t come up with the required payments by January 2. It made me wish the struggles of the real farm economy could be fixed in less than two hours. While this isn't possible, there are steps farmers can take to prepare for a meeting with their banker. This story outlines key points to consider.

Cash Flow and Tax Planning

November 3, 2016

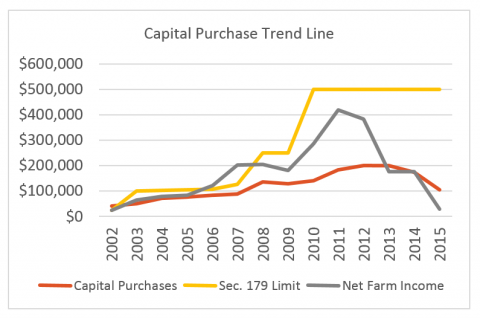

The author examines the differences between various farm income definitions and the economic implications of some of the short-term tax planning used in the last decade..