Agricultural Tax Planning in Low Income Years

October 25, 2016

Producers often feel there is no need to do tax planning in years when there is no profit, but in many ways, it’s more important to do tax planning in low income years than it is in high income years. There are many planning strategies that can be used to help save tax dollars over the long term if there is enough time to plan.

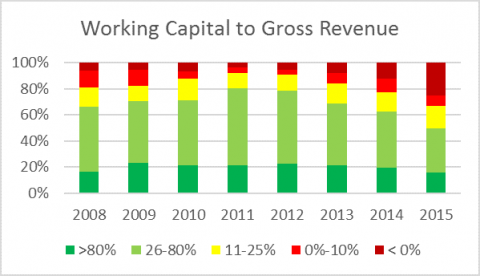

If Working Capital is Disappearing, What Should You Do?

July 15, 2016

In the July 13 UNL Cornhusker Economics, Tina Barrett, executive director of Nebraska Farm Business, Inc., writes: "It seems just about every farm management topic/article/presentation is talking about working capital these days. We’ve heard experts talk about “Cash is King” for years but why is it really important?

5 Tax Deductions for Your Farm

October 21, 2016

An updated version of this article is now available on farm.unl.edu.

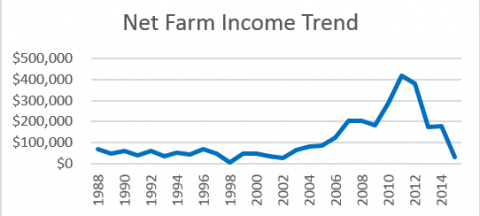

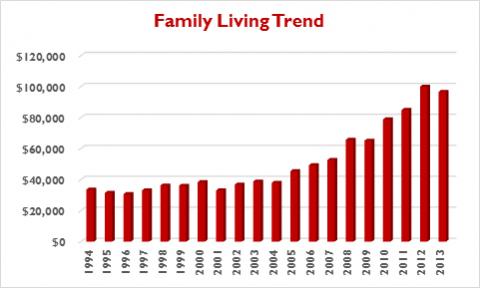

Nebraska Farm Income — What's Changed Since Prices Were Last This Low?

May 12, 2016

A closer look at costs and income for a group of Nebraska farms served by Nebraska Farm Business Inc. shows that while commodity prices and annual income may be similar to 2002, many other economic factors, including debt, have changed significantly. See what top third producers are doing, as well as what red flags to avoid.