New Program Aims to Help Socially Disadvantaged Ag Producers Access Capital

February 14, 2024

The program will assist underserved farmers and ranchers with finding affordable funding sources to start and grow their business.

NFarms Research Will Bring Precision Ag Innovations to Producers

February 14, 2024

The new NFarms facility, to be constructed at the Eastern Nebraska Research, Extension and Education Center, will be a test bed for new technologies, as well as platforms to help farmers better harness data.

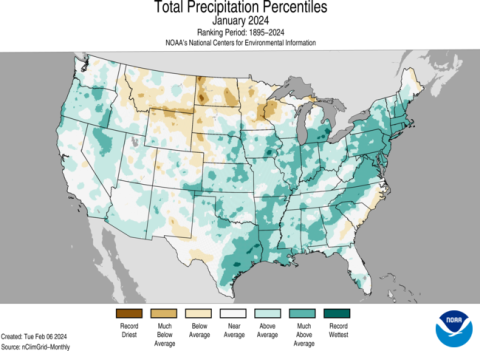

January 2024 Climate Summary

February 14, 2024

A prolonged polar vortex caused below-average temperatures and above-average precipitation last month, which had the added benefit of improving drought conditions in eastern Nebraska.

USDA NASS Announces Release of 2022 Census of Agriculture

February 14, 2024

Though the numbers of farms in Nebraska was down slightly in 2022, the value of ag products has risen by 34% since 2017.

Extension to Host Multi-state Emergency Preparedness Workshop Series for Rural Families

February 12, 2024

Hosted by local extension personnel in five locations across Nebraska, the workshop series will focus on farm and ranch emergency management, first aid, fire protection and hazardous materials.

Updates on Dicamba Products (Engenia, Tavium and XtendiMax) Applied in Dicamba-tolerant Soybean in Nebraska

February 12, 2024

UPDATED: Extension advises Nebraska soybean producers on the 2024 growing season after a Feb. 6 federal court ruling vacated registrations of dicamba-based herbicides Xtendimax, Engenia and Tavium.

High Plains Ag Lab Meeting to Focus on Research Updates

February 12, 2024

The Feb. 15 meeting will include updates on HPAL winter wheat fertility research and alternative crops breeding, wheat stem sawfly initiatives, TAPS wheat contest results, commodity marketing, HPAL 2022 crop production review and more.

Pasture and Forage Minute: A Closer Look at Section 180, Forage Inventory Season

February 6, 2024

With recent land purchases, many Nebraska producers are seeking to better understand IRS Section 180 tax deductions. This article provides a review of the tax code and its potential financial implications for landowners of newly acquired land.