Terminating a Verbal Farm Land Lease

August 2, 2017

Some farm leases are not written, but are verbal or "handshake" agreements, the details of which may be remembered differently by both parties. This article addresses the deadline for giving termination notice for crop land leases (Sept. 1), how the requirements differ for crop and pasture lands, and links to sample written leases.

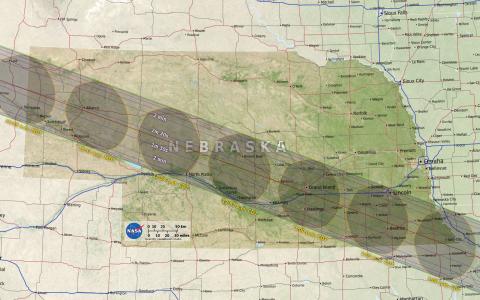

Q&A on 2017 Solar Eclipse and Nebraska Agritourism Liability

July 27, 2017

Nebraska will be host to thousands of visitors looking to catch the optimal view of the August 21 above our skies. Before opening up your lands to this agritourism opportunity, be sure to understand and addess your liability.

Kansas Federal Jury Awards $218 Million in Syngenta Litigation

June 29, 2017

On June 23 a federal jury awarded $218 million in damages to 7300 Kansas farmers for lost revenue from China rejecting corn shipments containing unapproved Syngenta varieties.

Property Owners Required to Keep Trees Out of Division Fences

April 19, 2017

Nebraska statutes require property owners to keep trees or bushes out of fences that divide their property from a neighbor’s. Nebraska revised statute section 34-103 states:

A Checklist for Farm/Ranch Debt Workout

March 14, 2017

Some Nebraska producers may be feeling a financial crunch and considering some unfamiliar options to manage their debt. For those negotiating a workout agreement with their creditor or creditors to restructure debt under challenging financial circumstances, the author lists several points to consider.

Nebraska Farm Credit Mediation

March 9, 2017

This year's historic weather events and low commodity prices are taking a financial toll on many farm operations and agribusinesses. Consider whether farm credit mediation, explained here, may offer an alternative to avoid loan foreclosure or bankruptcy.

Q&A on the IRS Portability Rule

March 1, 2017

A 2013 tax law change–the portability rule–can simplify farm and ranch estate planning. Farm and ranch families still need to do estate planning to develop and implement farm or ranch business transition plans so that the farm or ranch can continue to be successfully operated by the next generation. This Q&A addresses a number of questions.

Considering Ag Refinancing Options

February 28, 2017

In today's tight agricultural economy, a lender may require you to provide additional loan collateral—including land—as a condition for receiving continued operating credit. For example, if your carryover operating debt is $160,000, the lender might suggest moving the loan onto some land, machinery, or other property that is clear of debt.