2019 Nebraska Farm Real Estate Report

Download the full report, view report highlights for the state and each of its eight regions, and watch online presentations on the Nebraska agricultural land values and agricultural land cash rental rates for 2019. The report is in the Ag Real Estate Section of the Department of Agricultural Economics website.

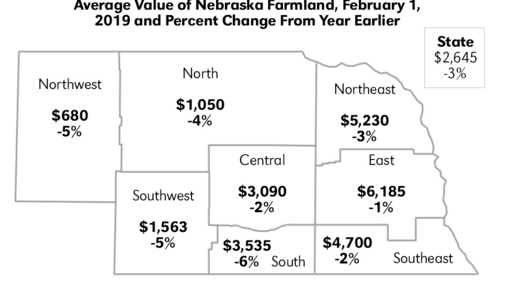

The all-land average value in Nebraska for the year ending February 1, 2019 averaged about 3% lower than the year before, according to the Nebraska Farm Real Estate Market Highlights report released this week by the Department of Agricultural Economics. This marks five consecutive years of declining land values, accounting for a total decline of 20%. The annual survey and resulting reports are by Jim Jansen, Nebraska Extension Economist and Educator, and Jeff Stokes, Hanson-Clegg-Allen Chair in Ag Banking and Finance.

The state average was $2,645 per acre or about a $75 per acre decline from the 2018 value of $2,720 per acre.

"Based on 2019 market values, the estimated total value of agricultural land and buildings in Nebraska fell to approximately $125.3 billion," notes the report. "Between 2018 and 2019, the market value decline in agricultural land and buildings totaled about $3.6 billion."

Some have compared the decline to that seen in Nebraska in the 1980s, but Jansen notes that conditions are much different now.

"This has been much more of a gradual decline," he said. "Farmers today are facing similar challenges as we did in the 1980s with low farm income," Jansen said, but how they've financed debt for land purchases and operating land credit has changed.

"As we see gradual change, it's important to understand what's happening across the state," Jansen said. The northwest (-5%), north (-4%), southwest (-5%), and south (-6%) districts saw the biggest declines in land value while northeastern (-3%), southeast (-2%), central (-2%), and east (-1%) districts saw more modest declines. The higher rates in decline ranging from 4% to 7% came from the northwest, southwest, and south districts where panel members noted restrictions in irrigation appropriations and new developments.

Panel members responding to the survey reported current crop prices, property taxes, and farm input costs as the most negative forces leading to the lower market value of land across the state. Additional economic forces placing strong negative pressure on the real estate markets included future property tax policies and the financial health of current owners.

The report includes land values and cash rental rates by district as well as by land type.

While preliminary numbers were released in March, this report represents the final survey results for 2019.