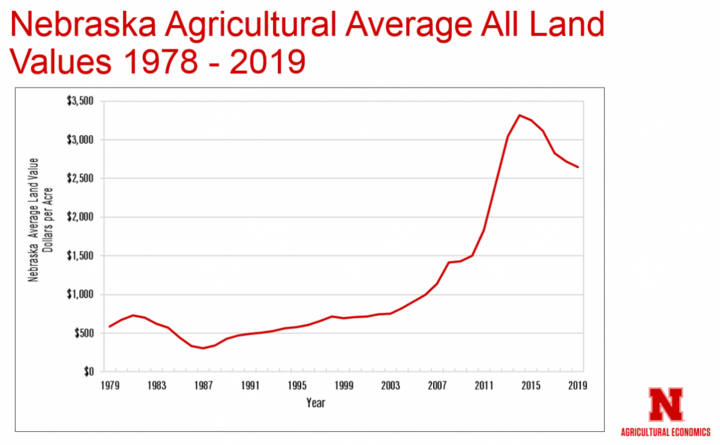

The market value of agricultural land in Nebraska declined by 3% over the prior year to an average of $2,650 per acre, according to the 2019 Nebraska Farm Real Estate Market Survey (Figure 1). This marks the fifth consecutive year of downward pressure as market values have dropped approximately 20% since reaching a high of $3,315 in 2014.

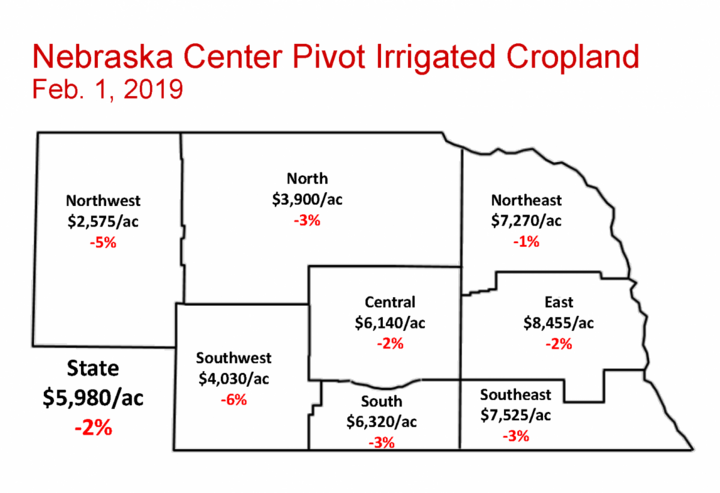

The highest reductions in irrigated cropland values were seen in the northwest, southwest, and south districts. “Survey participants indicated policies guiding the use of water as a key driver in the value of irrigated properties across these three regions,” the report noted.

Grazing land experienced the greatest decline in value, at 4%, led by steep drops in the Central District. While statewide values declined for all types of land, a small number of areas saw an increase. Most notable was the 6% increase in hayland values in the eastern district of Nebraska.

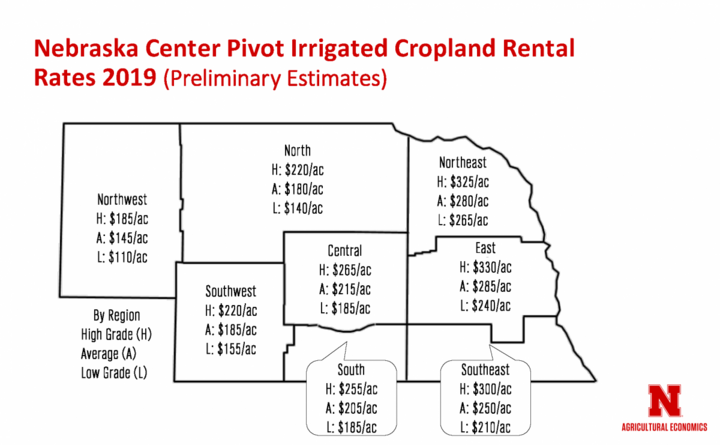

With a few exceptions, rental rates were generally down by 2%-6%.

Access a full set of maps illustrating cash rental rates by land use and district.

View the survey report with data tables and maps for various land uses and district, at the Farm Real Estate section of the Department of Agricultural Economics website.

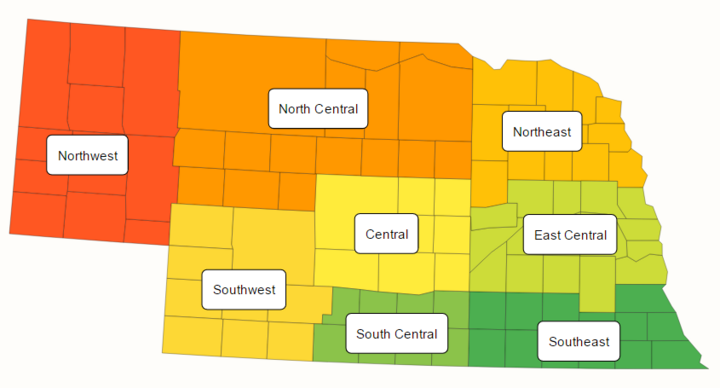

The land values and cash rental rates reported are based on surveys of Nebraska land professionals including appraisers, farm and ranch managers, and agricultural bankers. The annual surveys are conducted by the University of Nebraska-Lincoln Department of Agricultural Economics. Results are divided by land class and summarized by the eight Agricultural Statistic Districts of Nebraska (Figure 2).

“The value of what we have and the value of what we’re producing tend to trend together," said Jim Jansen, agricultural economist, and co-author of the report with Jeff Stokes, Hanson-Clegg-Allen Endowed Chair in Agricultural Banking and Finance. "The continuing challenges of low commodity prices are reflected in the real estate markets."

Considerations of Ag Land Rental Rates

“Many challenges exist between landlords and tenants when negotiating equitable land rental rates in 2019,” due to high agland property taxes and efforts to get a positive return for both parties.

“When negotiating for cropland, set an equitable cash rental rate that takes into account the revenue related to crop prices and yields – the rental rate needs to work for both parties,” Jansen said.

The irrigated rental rates reported assume the landlord owns the entire irrigation system. If a tenant provides a pivot or power unit, the cash rent should be discounted to reflect the tenant’s contributions to the lease, Jansen said. (See 2018 Cash Lease Adjustments on Irrigation Equipment for Cropland Rental Arrangements in Nebraska by Jansen and Stokes in the August 15, 2018 Cornhusker Economics.)

The rental rate also should account for tenants who provide a degree of service that the landlord may not be fully aware of when setting the lease. A tenant who helps maintain an irrigation system provides value to the landlord, who doesn’t have to hire a third party, Jansen said.

Similar considerations should be discussed when negotiating grazing land cash rental rates.

“Current livestock prices are making margins fairly tight for producers. A big question to ask when renting grazing land is ‘What degree of care might the landlord provide as part of the lease arrangement?’ Some landowners may offer upkeep of fences, water in summer, or assist with weed control. These services will provide value to a tenant, especially one who lives some distance from the property," Jansen said.

Report Highlights

Following are several highlights from the report.

Cropland Values

- The state average for center pivot irrigated cropland was $5,980 per acre (down 2%). Values ranged from $2,575 per acre (down 5%) in the Northwest District to $8,445 per acre (down 2%) in the East District.

- The state average for gravity irrigated cropland was $5,710 per acre, down 1% from 2018. It ranged from $2,150 per acre (down 8%) in the Northwest District to a high of $7,600 per acre (up 2%) in the East District.

- The state average for dryland cropland with irrigation potential was $4,005 per acre (down 3%). It ranged from $695 per acre (down 5%) to $6,140 (down 2%).

- The state average for dryland cropland with no irrigation potential was $3,045 per acre (down 2%). It ranged from $650 per acre (down 3%) to $5775 (up 2%).

Cash Rental Rates

- Average cash rental rates for center pivot irrigated cropland ranged from $145 per acre in the Northwest District to $280 in the Northeast District and $285 in the East District. Rental rates for parcels in the low third of quality ranged from $110 to $265. Parcels in the top third quality ranged from $185 to $330 per acre.

- Average cash rental rates for dryland cropland ranged from $27 in the Northwest District to $200 in the East District and $205 in the Northeast District.

Cow-Calf Pair Monthly Rates

- Average rates in this category ranged from $36.35 a month to $57.35 a month. Low-third rates ranged from $28.80 to $45.95. The high-third quality rates ranged from $46.30 to $72.00.

More Information

Read more of the 2019 Nebraska Farm Real Estate Preliminary Report at https://agecon.unl.edu/realestate where you can view related tables and district maps for various land value categories. View this week's Market Journal for an interview with Jansen on the Nebraska Farm Real Estate Market Survey.

How to contact the authors:

Jim JansenAgricultural Economist

University of Nebraska-Lincoln

jjansen4@unl.edu

402-261-7572 Jeff Stokes

Hanson-Clegg-Allen Endowed Chair

Agricultural Banking and Finance

University of Nebraska-Lincoln

jeffery.stokes@unl.edu

402-472-1742

Preliminary land value estimates are published annually on the second Wednesday in March. The final report is published in early June. For more information and to see related resources, go to agecon.unl.edu/realestate