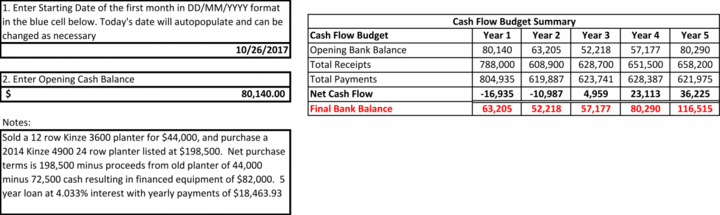

Cash flow statements and budgets are a crucial part of the farm and ranch business financial management. Cash flow statements allow farm and ranch managers to track the actual inflows and outflows of cash. Cash flow budgets are used to predict and plan for inflows and outflows of cash. By comparing the cash flow statement to the cash flow budget managers can review the implementation of the cash flow budget by looking and studying the variances. Cash flow budgets also allow farm and ranch owners to plan borrowing, credit lines, and capital purchases. Cash flow planning and analysis are standard business practices and are superior business management tools for Nebraska farm and ranch managers.

The primary use of a cash flow budget is to project the timing of cash inflows and outflows and then to plan for borrowing if shortfalls in cash flow occur. Managers can then design a borrowing and repayment plan that fits the farm’s or ranch’s income and expense timing. A cash flow budget can also point to ways to more efficiently time expense payments. For instance, if a farm sells wheat at harvest, a significant expense such as insurance or fuel needed for fall harvest might be scheduled at that time as well. This example shows one way management can avoid drawing on personal funds or an operating loan through cash flow planning. Cash flow planning might include family living costs along with farm and ranch income and expenses. Once management develops a cash flow plan, they can arrange an appropriate line of credit with a lender.

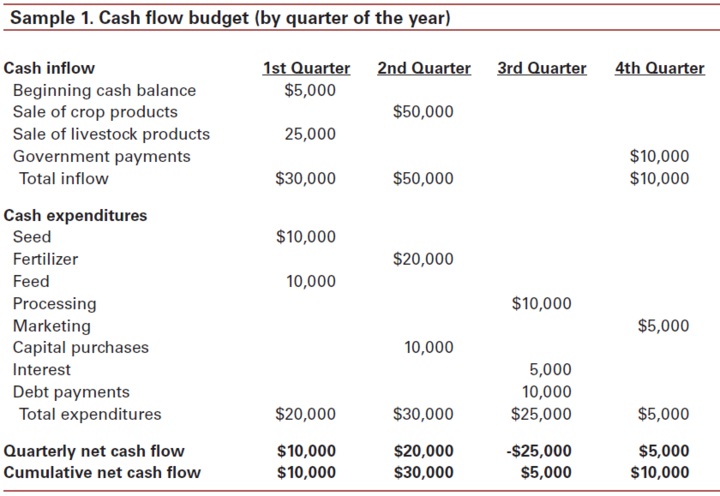

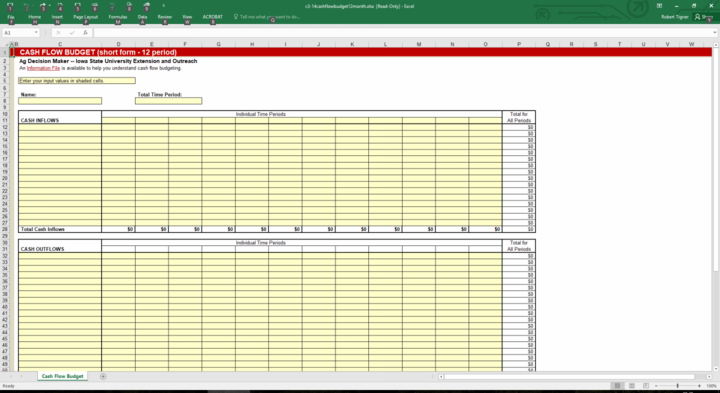

Management can use a cash flow budget as a monitor and control for cash outflows and inflows for the year. The sample cash flow budget shows a cash flow budget by quarter. Cash flow budgets may also be prepared using a monthly or bi-monthly schedule as well, but are all formulated around a one-year length of time. A statement of actual cash flow is then composed as the year proceeds and managers compare that to the budget made earlier to monitor cash inflows and outflows. Managers can develop a cash flow budget in one of two ways:

- Use last year’s cash flow and adjust cash outflows and inflows by the expected change in expenses and income.

- Use enterprise budgets to build a cash flow budget. The second method is very detailed and takes into account changes in cropping and livestock production such as different crop acres or more cows to calve for the coming year.