Ag Accounting: The Ins and Outs of Prepaid Expenses

November 12, 2018

Are you considering some late 2018 purchases? Three factors can help you and your tax preparer determine whether they meet the Internal Revenue Service requirements for a prepaid expense.

Section 199a of the New Tax Act – The 20% Pass-Through

August 22, 2018

Implementing one of the new tax law changes, Section 199a - the 20% Pass-Through, may offer some challenges to tax preparers working with ag producers who qualify both as business owners and co-op members.

Financial Impact of the Tax Cuts and Jobs Act on Ag Producers

August 22, 2018

As experts continue to interpret the new tax code, two things are certain for ag producers: The changes are far reaching and complex and in many cases, will result in a lower tax liability. This overview looks at several of the major changes affecting ag producers.

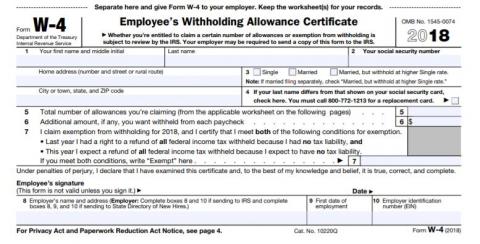

Accounting for Agriculture: Federal Withholding after New Tax Bill

July 11, 2018

With the higher standard deduction and changes in child credits in the new US tax code, taxpayers may need to reconsider how much to withhold for federal taxes in each pay period. Here are information and a tool to help you assess your situation.

Trading Equipment Without Like Kind Exchange

May 22, 2018

Learn how the new federal tax law affects depreciation and basis with new ag equipment purchases. This is one in a series of articles on accounting considerations for ag operations.

Accounting for Agriculture: Who’s a “Related Person”?

May 14, 2018

Understanding the IRS definition of family and its implications for your taxes is important when doing business with "related persons." This is one in a series of articles on Accounting for Agriculture.

Tax Reform Workshop March 14 at Scottsbluff

March 7, 2018

Western Nebraska farmers and ranchers are invited to a tax reform workshop March 14 to learn about the impacts of the 2017 Tax Cuts and Jobs Act on their 2018 tax liability.

Accounting for Agriculture: Personal Property Tax Relief Act

March 5, 2018

With new changes in tax laws and likely more on the way, if you have tangible property in several districts, consider this option for taking more than one personal property tax exemption. With a little more paperwork, you can keep more of your income on the farm or ranch.