Crop Insurance Premium Subsidies Influence on Family Farms

November 4, 2021

Though taxpayer-subsidized crop insurance programs are successful in increasing participation, an unintended consequence of such programs has been farm consolidation.

Cornhusker Economics: 2020 Nebraska Property Tax Changes

August 27, 2020

The Nebraska Unicameral enacted significant property tax relief legislation in the closing days of the 2020 legislative session. The compromise establishes a refundable state income tax credit of an estimated 6% of the property taxes paid for local schools (excluding property taxes for school bonds and school budget overrides).

Cornhusker Economics: An Illustration of Farm Program Decisions and Impacts

October 30, 2019

While the ARC and PLC programs were carried over from the 2014 Farm Bill with relatively modest changes, the substantial drop in market prices and outlook since 2014 pointed toward a widespread shift in enrollment away from ARC and toward PLC due to the increased relevance of the price safety net. However, with this year’s extreme weather events, concerns over crop production, and hopes for improved trade prospects, there has been some recovery in commodity prices that could affect farm program supports and producer preferences. The author looks at various program options and the impacts of selecting them.

Managing a Farm/Ranch Transfer to the Next Generation

August 23, 2019

Successfully getting the next generation to return to the farm and then keeping them on the farm can be accomplished through four stages that can help all the family make a peaceful transition.

The Value of Grazed Corn Residue for Crop and Cattle Producers

July 31, 2019

It's estimated that a 10% increase in grazing utilization of corn residue could add $6.4 million to the bottom line of crop producers in Nebraska.

Cover Crop Use and Implications for Cropland Lease Arrangements in 2019

July 8, 2019

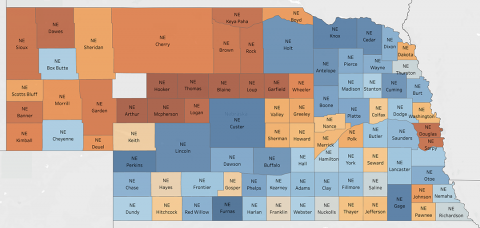

Cover crops were planted on almost 750,000 acres in Nebraska in 2017, the last year of the USDA Ag Census. A recent Cornhusker Economics reports cover crop acreage by county as well as how to consider their short-term costs and potential long-term benefits when negotiating crop land leases.

New Law Allows Lower Taxes for Flood-Damaged Property

June 5, 2019

A new Nebraska law provides that property owners who suffered significant flood damage can apply to have their 2019 property taxes lowered. Damage must be reported on a new state form by July 15.

Risk Management Center Trains Growers to Manage Complex Risks

May 15, 2019

After several years of agricultural prosperity and US net farm income that peaked at almost $124 billion in 2013, the most recent forecast from the UDSA Economic Research Service projects net farm income at less than $70 billion for 2019. The Extension Risk Management Education program helps farmers learn how to navigate the many risks they face.