Nebraska Extension to Host Grain Marketing Workshops in Crawford, Oshkosh

January 18, 2024

Real audio and video examples of grain market analysts will be used during the workshops to help producers decode market lingo and hone their marketing skills.

The Economics of Deficit Irrigation Utilizing Soil Moisture Probes

December 15, 2023

Cornhusker Economics experts examine the financial impact on producers using a deficit irrigation strategy in corn.

What Happens to Your Farm or Ranch if You Become Disabled?

December 14, 2023

Labor contingency plans, emergency funds, buy-sell agreements, insurance — there's many factors to consider when preparing for a potential disability on the farm. Read this article for more on what to expect of the process.

Custom Operators Invited to Participate in UNL Nebraska Custom Rates Survey

December 7, 2023

Part one of the survey covers spring and summer operations such as tillage, planting and haying, and part two surveys fall operations, including grain harvest, hauling, cutting ensilage and other miscellaneous operations.

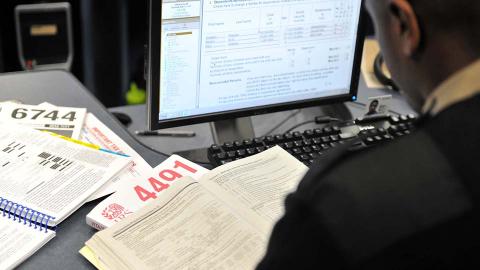

2023 Income Tax Updates for Farmers and Ranchers

December 1, 2023

This webinar reviews 2023 tax considerations for ag producers, including crop insurance, deferral options for livestock sales, potential law changes and more.

UNL Webinar to Cover Corporate Transparency Act Requirements for Farm and Ranch Businesses

November 29, 2023

Webinar participants will learn more about the act, why it was adopted and what information will need to be filed in 2024 for farm and ranch businesses.

2024 Nebraska Crop Budgets — A Mixed Review With Some Costs Higher, Some Lower

November 17, 2023

Glennis McClure, Nebraska Extension educator and farm and ranch management analyst, reviews her projections for cost of crop production in 2024.

What is IRS Section 180 and How Does it Work?

November 16, 2023

With recent land purchases, some producers are asking questions to learn more about IRS Section 180 and how it may provide tax deductions in the year of purchase.