March 21, 2008

Strong crop commodity prices in 2007 continued to drive up Nebraska farm real estate values, with a 23% increase marking the steepest gain in the 30 years the University of Nebraska-Lincoln has tracked the ag land market.

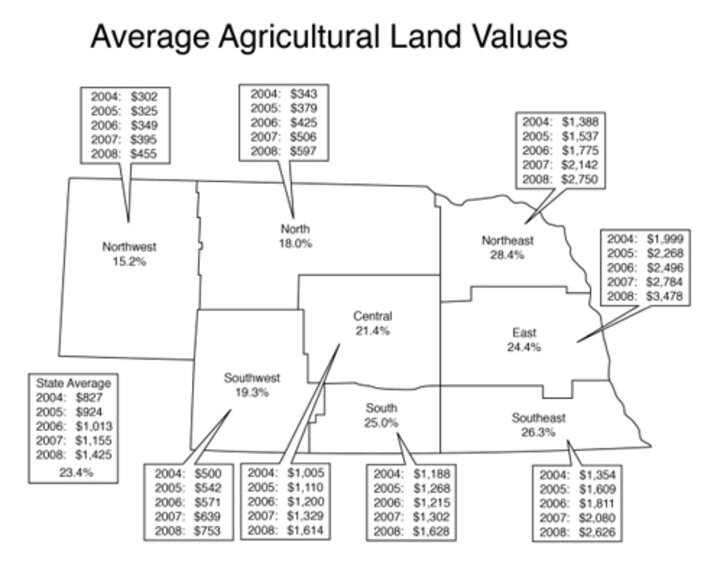

The state's all-land average value was $1,425 per acre as of Feb. 1, according to preliminary findings in the Nebraska Farm Real Estate Market Survey (Figure 1). That's up from $1,155 last year.

The increase continues a five-year trend that puts average agricultural land values 88% higher than they were in 2003, said Bruce Johnson, the UNL agricultural economist who conducts the survey.

"Today's level represents a new historical peak value, not only in nominal terms but also in real, inflation-adjusted terms," Johnson said. The previous peak in inflation-adjusted dollars was in 1981, just before a major drop in land values during the farm-crisis years of the mid-1980s.

"The underlying causes of this new plateau are fairly obvious. Corn demand from the rapidly growing ethanol industry in the state fueled prosperous returns across the corn producing areas of the state," Johnson said.

"This, in combination with rising world demand for essentially all of Nebraska-grown commodities, has created a phenomenal income effect across the entire state," Johnson added. "And, true to economic logic, those income signals get capitalized into agricultural land values relatively quickly." Preliminary estimates from the 2008 survey show the largest percentage gains in the northeast region, up 28%, followed closely by the southeast region, up 26%. The smallest of the regional gains was 15% in the northwest, where the impact on land values of commodity price surges have been more recent. "By type of land, value changes clearly reflect the recent income patterns and economic opportunities," Johnson said. For example, nontillable grazing land recorded the smallest state-wide percentage gain for the year — 12 percent — as the cattle economy strains to adjust to higher feed costs.

"The fact that the state's cattle industry is effectively using the distillers grains byproduct from the ethanol industry has partially mitigated the feed cost impact on the fed-cattle component," Johnson said.

"Still, profits have all but disappeared in the short run. In the longer run, the economic picture seems brighter. The limited supply of forages as well greater substitution of forages for corn in the cattle feeding cycle may be part of the market participants' willingness to bid grazing land values upward."

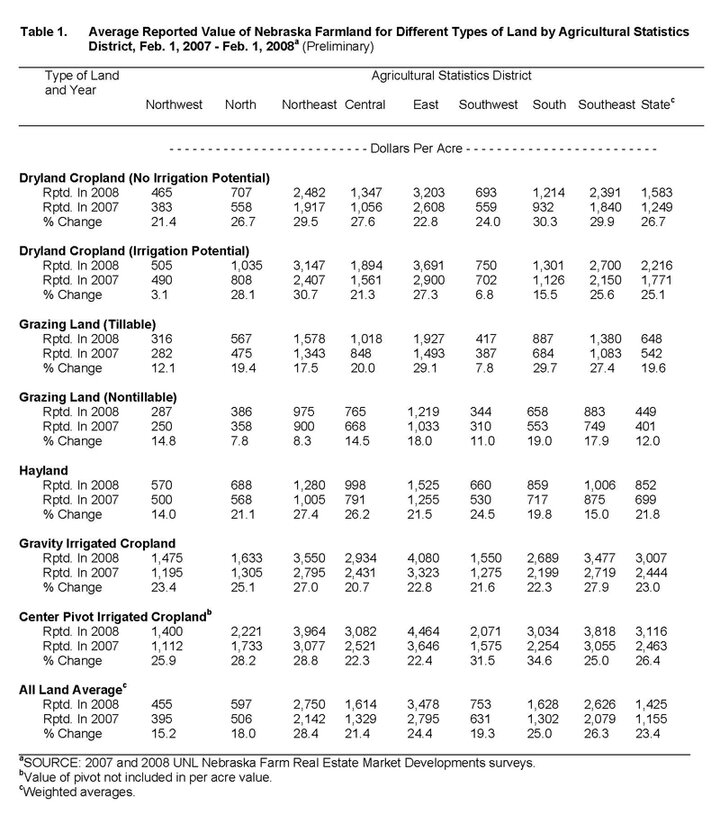

In regions where irrigation water moratoriums on future drilling are already in place, the value of dryland cropland with irrigation potential showed only modest gains in the last year (Table 1). However, this type of land experienced large value advances in the north and northeast parts of the state where additional irrigation development is unrestricted.

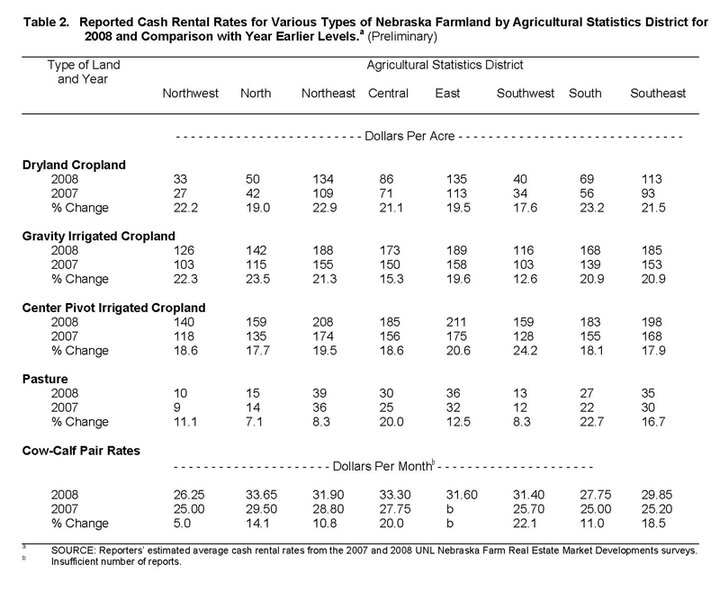

The cash rent levels for cropland also surged in the last year (Table 2). Increases range from 17% to 23%, and are reflected across the entire state, Johnson noted. The cash-rent increases also were the highest increases ever recorded in the annual survey. The highest cash rent averages were reported for center pivot irrigated cropland in the east and northeast, where 2008 rents top $200 per acre. As for pasture, 2008 rates were also up over 2007's levels — both on a per-acre rate and on a cow-calf pair monthly basis. However, in most areas of the state, the percentage increases for pasture rates were below those recorded for cropland.

Research Division. Final estimates will be available in a report this summer.

For more details on preliminary 2008 values and cash rents by region and class of land, see the March 20 Cornhusker Economics.

Dan Moser

IANR News Service