Producers must make new farm program decisions at USDA’s Farm Service Agency (FSA) for the 2019 and 2020 production years before the March 15, 2020 deadline. The programs look familiar, as the 2018 Farm Bill maintained the existing Agricultural Risk Coverage (ARC) program at both the county level (ARC-CO) and individual (farm level) coverage level (ARC-IC) as well as the existing Price Loss Coverage (PLC) program. However, there are some changes to the programs for producers to note. Perhaps most significantly, producers face a new enrollment decision between ARC and PLC and do so under a very different economic setting than the last decision back in 2014.

Farm Program Changes

The first change of note is an opportunity to update farm program yields for purposes of the PLC program. Producers can and should look at updating yields regardless of which program they choose, given that payment yields are tied to the farm and the base acreage indefinitely, including potential future farm programs. The update is complicated by a formula designed to adjust for general national yield changes since the last update in 2014, but the net result is that producers can choose on a crop-by-crop basis to keep their existing program payment yields or update yields based on their 2013-2017 average yields multiplied by a specific factor. That factor is 81% for corn and soybeans, 81.7% for grain sorghum, and 85.9% for wheat. (See the farm bill educational materials at http://farmbill.unl.edu for other crops and further information.)

A second change is a potential adjustment up in the PLC reference price, but only if the five-year Olympic average of the national marketing year average prices goes up enough such that 85% of the five-year Olympic average exceeds the existing reference price. For the major commodities, that is unlikely to happen for the life of this farm bill, resulting in reference prices that will likely remain at legislated levels ($3.70 for corn, $8.40 for soybeans, $3.95 for grain sorghum, and $5.50 for wheat).

On the ARC program, a couple changes could improve the relevance of the yield in the revenue calculations. County yield data for the ARC-CO program previously relied first on survey data collected through USDA’s National Agricultural Statistics Service, but will now work first from crop insurance data reported to USDA’s Risk Management Agency. This should improve the availability and consistency of yield data across counties for major crops and major production regions, but there will still be gaps in the data that will have to be addressed by FSA each year. More significantly, the historical yield data that goes into the ARC benchmark and guarantee calculations will be trend-adjusted using the same trend-adjustment factor as used for crop insurance. This will help produce a yield benchmark consistent with current trend yields and eliminate the “hidden deductible” of a guarantee built on historical yields against current trend-yield expectations. Another change to the ARC program will affect producers with both irrigated and non-irrigated practices as well as producers with a farm (FSA farm number) with tracts in multiple counties. While benchmarks and guarantees are calculated separately, practices are blended together and tracts across county lines are blended together in determining total payments to a producer on a given farm.

Farm Program Analysis

With ARC-CO, ARC-IC, and PLC programs largely intact from the previous farm bill, the enrollment decision looks familiar. But, with changes in market conditions and potential impacts of 2019 production results already in the books, the enrollment decision now for the 2019 and 2020 production years could be substantially different than back in 2014.

The PLC program provides price loss protection below the reference price tied to program yields and 85% of base acres. The ARC program provides protection for revenue losses below 86% of a benchmark revenue down to 76% of the benchmark. Payments under ARC-CO are determined by crop and paid on 85% of base acres while payments under ARC-IC are determined by a blend of all program crops on the farm and are paid on 65% of total base acres.

In 2014, historically high prices and a relatively strong price outlook translated into less expected PLC support and stronger ARC support for corn and soybeans. This led to enrollment of more than 95% of base acres of those crops in ARC-CO. Price expectations were relatively lower for grain sorghum and wheat, at least relative to the PLC reference price levels, and thus there was a much more even mix of ARC and PLC enrollment.

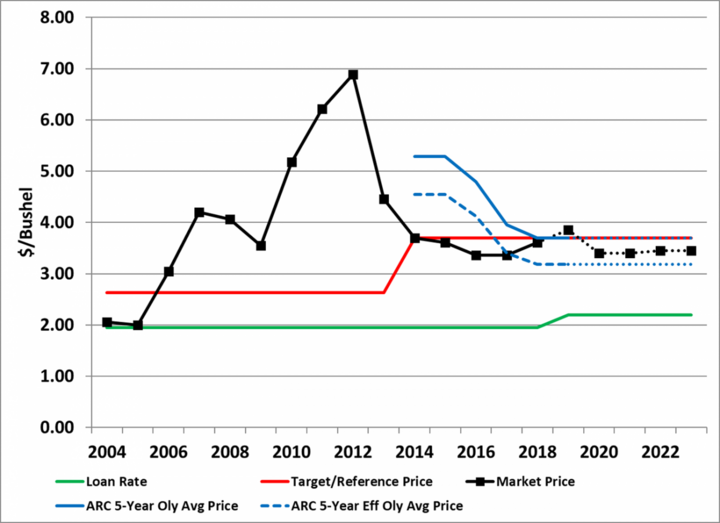

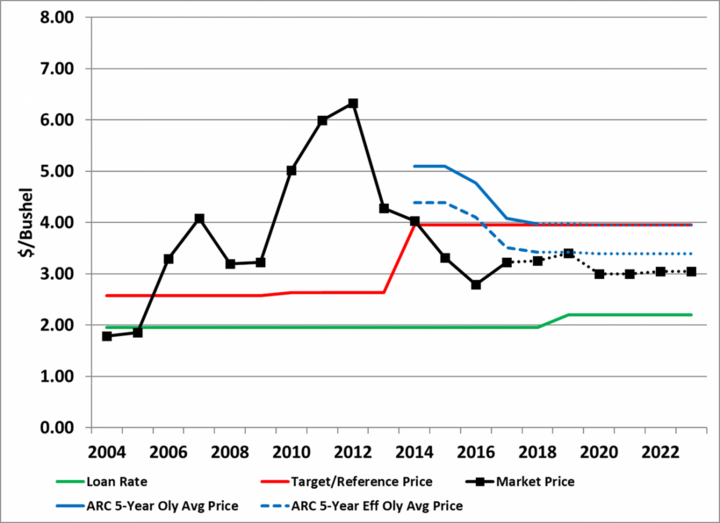

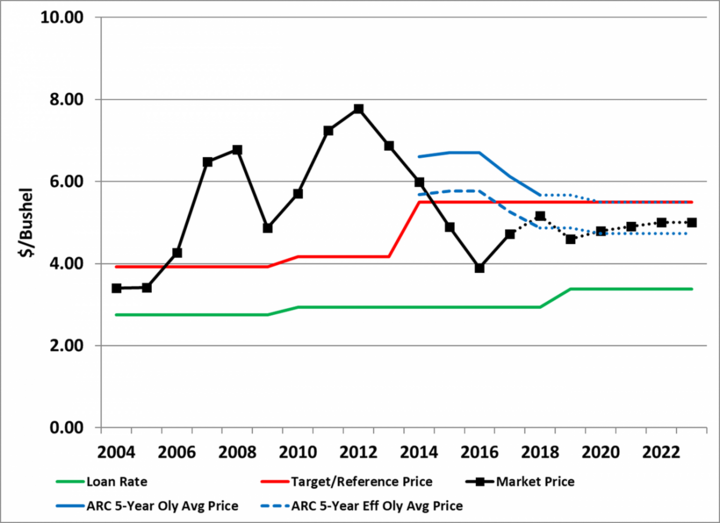

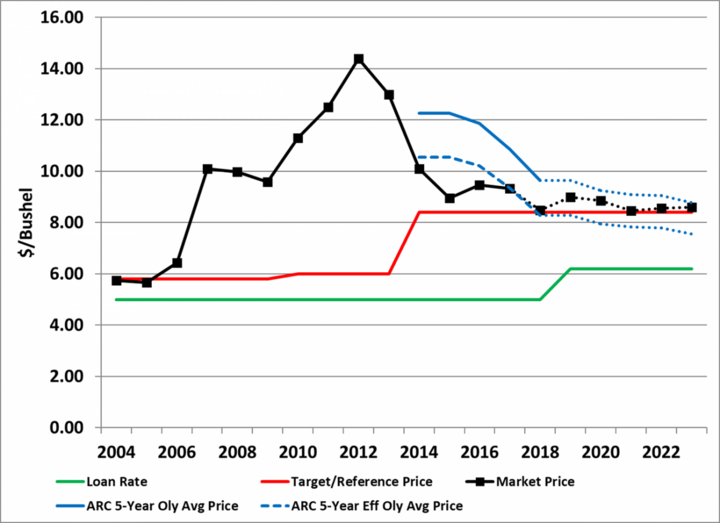

The 2014 decision was a single decision for the entire 2014-2018 period and weaker prices over the life of the farm bill gradually reduced the support of the ARC program while the PLC program became more relevant. Now, producers face a 2020 decision for just the 2019 and 2020 production years and current lower prices and expectations are likely to drive more consideration toward the PLC program. Figures 1-4 show the relative support levels of the PLC program and the ARC program and provide some perspective on the decision, given current price projections for 2019-2023 from USDA.

For corn in Figure 1, the 2019 projected price of $3.85 (as of the November USDA supply and demand report) is above the $3.70 reference price, but would offer protection if the average price fell much below current levels. For 2020, the projected price of $3.53 comes from USDA long-term baseline projections released in November 2019. While the projections are not market forecasts per se, they do provide the perspective that absent major shifts in market fundamentals, prices could continue to linger around current, lower levels. At those lower levels, PLC would offer substantial payments to help offset the effect of lower prices. In comparison, ARC protection kicks in below a guarantee equal to 86% of the benchmark revenue (benchmark yield times benchmark price). Assuming trend yield levels (no yield loss), the 14% “deductible” would come from price loss alone. Given a benchmark price equal to the five-year Olympic average price that has fallen to its minimum at the $3.70 reference price for corn, ARC protection effectively kicks in at 86% of the $3.70 benchmark, or about $3.18. This is not an apples-to-apples comparison as PLC covers price loss only and ARC covers revenue losses resulting from yield and/or price losses, but it does show that ARC protection levels generally fall below PLC protection levels at present absent a significant yield loss.

The analysis looks similar for grain sorghum in Figure 2 and wheat in Figure 3 and even favors PLC more given the weaker prices and prospects for those crops relative to reference price levels. For soybeans in Figure 4, the analysis is less certain. Soybeans have seen the same general price decline as other crops since 2014 and face relatively flat price projections going forward (barring major changes in market fundamentals). However, the price drop has only come down to levels near the PLC reference price of $8.40 and prices and projections have yet to drop below that level. As such, PLC has yet to trigger for soybeans, although it remains a price safety net just below current market projections. Like the other crops, ARC likely would kick in below PLC trigger levels, assuming trend yields, but could offer more protection than PLC if there is any yield loss to count as well.

While the decision between PLC and ARC-CO is on a farm-by-farm, crop-by-crop basis, it is worth considering the potential role of ARC-IC as well. ARC-IC was not widely chosen back in 2014, in part due to the complexity of the program as well as the five-year commitment from 2014-2018. The ARC-IC calculations are still complex, but with the decision now just for 2019 and 2020 and with 2019 production results already known, the potential protection and support provided by ARC-IC can be more readily calculated and considered. ARC-IC works generally in line with ARC-CO, but calculates a guarantee based on historical farm-level revenue from program crops on an annual basis averaged over the benchmark period by crop and then weighted for the current production year accordingly to actual planted acreage. Revenue across all planted acreage of program crops on the farm is calculated against the guarantee to determine any revenue loss per acre that is then paid on 65% of total base acres.

The particular relevance of ARC-IC comes in the case that there were widespread production losses on the farm in 2019. If there were large losses on the farm, those could quickly accrue into large ARC-IC payment rates for 2019. Even though the current enrollment decision is a commitment for both 2019 and 2020, known losses in 2019 could swing the analysis toward ARC-IC on a farm-by-farm basis. Of further note, ARC-IC revenue levels and payments are specifically determined from planted acreage, so the performance of only planted acres matter even if there are large tracts of prevent-plant acres on the farm. However, in the particular case that the farm was 100% prevent plant, the prevent plant acres do count and the revenue to count against the guarantee would be $0, resulting in maximum ARC-IC payment rates. This could certainly tip the scales in any decision as to whether or not to enroll in ARC-IC, but it is also important to note that all of a producer’s farms (separate FSA farm numbers) that enroll in ARC-IC (in a single state) are combined together in a single ARC-IC calculation. Thus, significant losses on some farms could be offset by good results on other farms, leading to reduced ARC-IC payments.

Given the complexity of the programs and the uncertainty surrounding prices and yields, producers would definitely benefit from doing a careful analysis of relative protection and projected payments under the PLC, ARC-CO, or ARC-IC programs. Two online decision tools developed in cooperation with USDA are available under the resources tab on the ARC and PLC program page on the FSA website. Additional information, analysis, and resources are also available on the Nebraska Extension farm bill website.

Risk Management Impacts

While the above analysis and the output of the online decision tools is specifically focused on the farm program decision currently facing producers, that decision could also impact a producer’s risk management decisions.

As noted in the discussion, PLC provides price protection tied to reference price levels, but only for crops in the farm’s base and then only on program yields on 85% of base acres. Even with updated program yields, the yields may reflect 81% of the 2013-2017 average, which itself could be 10% or more below expected yields. Altogether, it could mean that PLC price protection really only protects about 60% of the expected production (on a crop with corresponding base acres).

ARC provides revenue protection from the combination of price and/or yield loss but only on revenue losses in the range of 76-86% of the benchmark revenue. This may correspond with upper levels of crop insurance coverage between the 75% and 85% protection levels, but ARC-CO is a county-level safety net as opposed to individual farm-level crop insurance decisions and ARC-IC is a farm-level safety net across commodities, much like upper protection levels of the whole farm revenue protection policy.

One additional complication to add to the mix is that producers that do not enroll in ARC for a given farm or commodity on the farm are eligible to purchase a crop insurance product called the supplemental coverage option (SCO). SCO is a county-level policy that protects the band of losses below 86% and whatever level of underlying coverage the producer purchases. Thus, between 86% and 75%, SCO may look a bit like and even possibly substitute for ARC, although SCO is fully a crop insurance product tied to current year price levels and protection, so the two are not equivalent.

Altogether, it is a reminder that the farm program decision is about more than just the program support and expected payments. Farm programs, whether PLC or ARC, provide important income support and risk management features, and may sometimes supplement and sometimes compete with other risk management decisions and tools for marketing and crop insurance. Given the enrollment period now for farm programs, it is likely that the farm program decision will be made first with other risk management decisions to be made as time goes by, knowing how farm programs could interact with those decisions along the way.