China is a major importer of agricultural goods, importing an estimated $107 billion in agricultural products from 2012-16 (USDA FAS GATS). The U.S. accounted for 23% of the value of these imports. New tariffs between China and the U.S. have prompted many questions about agricultural trade between these two nations, especially from soybean producers.

Global Trade Acronyms

USDA FAS GATS — USDA Foreign Agricultural Service Global Agricultural Trade Systems

USDA FAS PS&D — USDA Foreign Agricultural Service Production, Supply and Distribution Online

USDA WASDE Report — USDA World Agricultural Supply and Demand Estimates

USDA ERS - USDA Economic Research Service

What is a tariff? A tariff is a tax charged on foreign products at the border. Tariffs effectively increase the price of foreign goods, discouraging domestic processors and consumers from purchasing foreign goods.

What tariffs have been implemented so far? Beginning July 6, the U.S. placed a 25% tariff on $50 billion of Chinese products entering the U.S. These tariffs were justified by claiming that China has been “stealing American technology and trade secrets.” The U.S. has threatened additional tariffs if China retaliates to our tariffs.

In retaliation, China placed tariffs on U.S. products, including a 25% tariff to U.S. soybeans on top of the standing 3% duty, another form of import tax, they charge for all imported soybeans. China also dropped the 3% duty for soybeans from Bangladesh, India, Laos, South Korea and Sri Lanka, hoping to encourage these nations to sell more soybeans to them. Furthermore, China has also canceled orders for U.S. soybeans that they had previously committed to buying.

What percent of U.S. soybeans are exported? According to USDA FAS PSD, from 2012/13-2016/17 about 50% of U.S. soybean production entered export channels. China is the leading consumer of U.S. soybeans, accounting for about 60% of U.S. exports.

How big is the Chinese soybean market? According to the June USDA WASDE report, China is expected to import 97 million metric tons (MMT) of soybeans in 2017/18. If China does not import soybeans from the U.S., they will have difficulty meeting this expectation as the remaining major exporters (Brazil, Argentina, Paraguay, and Uruguay) are only expected to export 86.05 MMT of soybeans.

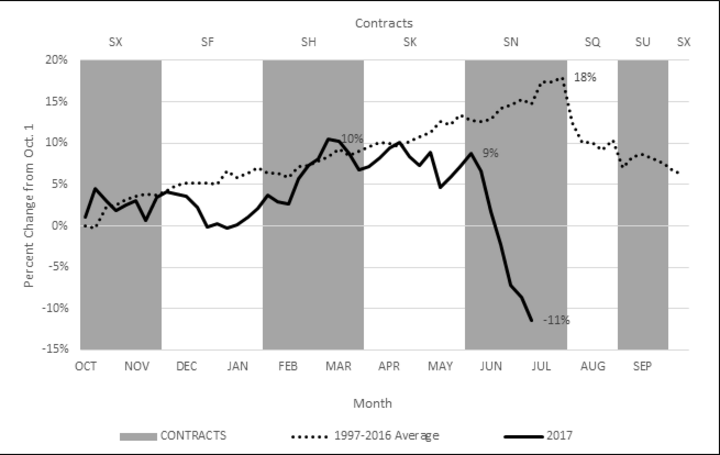

How have prices reacted? From October 2017 to early June 2018 soybean prices had a reasonably normal price pattern. However, as of July 1, 2018, nearby contract futures prices had dropped 11% since October 1, 2017 (Figure 1). Although this price decline is concerning, USDA ERS estimates that approximately 91% of U.S. soybeans harvested in 2017 should have already been sold by farmers as of June 1.

The larger concern should be for the crop that will be harvested in fall 2018. However, some farmers may have already used pre-harvest marketing strategies to lock in a higher price. The quantity of 2018 soybeans already priced is unknown.

What can soybean farmers do to reduce the impact of the recent price declines?

First, farmers should be aware that their crop insurance policies protect them from declining prices. Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RP-HPE) policies insure against declines in futures prices between spring and fall. The spring price, called a projected price, and a producer’s Actual Production History (APH) yield are used to calculate each farmer’s individual revenue protection level.

In 2018 the projected price for soybeans is $10.16/bu. Assuming a farmer’s actual yield is equal to their APH, a producer with an 85% insurance coverage level will have a price floor of $8.64/bu. ($10.16/bu. X 85%). If the fall price is below $8.64/bu., a crop insurance indemnity payment will be provided to the producer.

Since these policies insure revenue, experiencing yields lower than APH will increase the price floor while yields higher than APH will lower the price floor. The price floor also declines as the selected coverage level declines. In 2018 soybean crop insurance price floors are: $8.13/bu. with an 80% coverage level, $7.62/bu. with a 75% coverage level, and $7.11/bu. with a 70% coverage level.

Soybean farmers also need to write a proactive marketing plan to help combat rash marketing decisions. This plan should include strategies for marketing the crop in the bin and marketing the crop in the field.

Grain in the Bin. The recent decline in price puts today’s cash prices lower than what was available at harvest 2017. Farmers who still have 2017 soybeans in the bin should consider pricing them sooner rather than later. Soybean prices are expected to decline in July and August in anticipation of harvest on top of downward pressure being placed on the market by the trade dispute with China. Furthermore, the differences between soybean futures market contract months are not large enough to cover the cost of further storage. This is yet another reason to sell grain in the bin.

Grain in the Field. There are still several opportunities for farmers with unpriced soybeans in the field to reduce their price risk. The strategy farmers should employ depends on their price expectation.

Futures Price Decrease: For farmers concerned that the trade dispute will continue and prices will decline into 2019, pre-pricing soybeans now may be a viable marketing strategy. Here are a couple of options to manage price risk given this market expectation.

- For farmers certain that futures prices and basis will decline this fall the easiest way to decrease the price risk is to cash forward contract with a local elevator. This contract eliminates downside price risk but also eliminates upside risk if the futures market recovers.

- Farmers wanting to limit their downside risk but not their upside opportunities should consider a short hedge and buy a call option or buy a put option. Short hedges and put options can be combined with a basis contract to limit basis price risk while capturing value from declines in prices.

Futures Price Increase: Farmers who feel that soybean price declines are only temporary and will recover have a few marketing strategies available to limit price risk.

- Farmers could leave soybeans unpriced if they think prices will improve by harvest. If prices have not improved by harvest, they could place unpriced soybeans in the bin in anticipation of basis and futures price increases later in 2018 or early in 2019. This strategy leaves farmers open to both upside and downside price risk.

- Farmers wanting to limit their downside price risk could use a minimum price contract. This contract requires the farmer to set the basis when the contract is signed but allows the farmer to change the futures price of the contract if it goes up within a specific timeframe.

Caution must be given to not oversell pre-harvest bushels. Each farmer must determine expected production and the percentage of that production they are comfortable with pre-pricing. Not pre-harvest pricing any grain is an option. However, given the drastic decline in soybean futures market prices, producers should consider forward contracting some of their anticipated production to eliminate some of their downside price risk.

Remember, past performance is not necessarily indicative of future results. Grain marketing involves risk, and you should fully understand those risks before pricing grain.