The August World Agricultural Supply and Demand Estimates (WASDE) is the first report to estimate U.S. soybean and corn yields for the coming harvest (2017).

Looking at historical price patterns, once this report is released, soybean prices on average decline and become more volatile. As a result, the August WASDE represents an important piece of information influencing market prices. This article will discuss mid to late summer price expectations and marketing strategies for old crop and new crop soybeans.

| Nearby | 1st Differed | 2nd Differed | 3rd Differed | |

|---|---|---|---|---|

| Date | SN17 | SQ17 | SU17 | SX17 |

| 7/3/2017 | $9.65 | $0.05 | $0.09 | $0.16 |

| 7/5/2017 | $9.76 | $0.06 | $0.10 | $0.18 |

| 7/6/2017 | $9.81 | $0.05 | $0.10 | $0.19 |

| 7/7/2017 | $9.96 | $0.05 | $0.10 | $0.19 |

| 7/10/2017 | $10.20 | $0.04 | $0.10 | $0.19 |

| 7/11/2017 | $10.25 | $0.04 | $0.09 | $0.18 |

| 7/12/2017 | $10.17 | $0.04 | $0.08 | $0.17 |

| S is the Chicago Board of Trade notation for the soybean market, the letter following S represents the delivery month of the contract. The dates in parenthesis below denote the dates this contract is the nearby contract. X- November (Sep. 15 – Nov. 14), F- January (Nov. 15- Jan 14), H – March (Jan. 15-Mar. 14) K- May (Mar. 15-May 14), N-July (May 15-Jul. 14), Q- August (Jul. 15-Aug. 14), U – September (Aug. 15- Sep. 14). | ||||

Old Crop Soybean

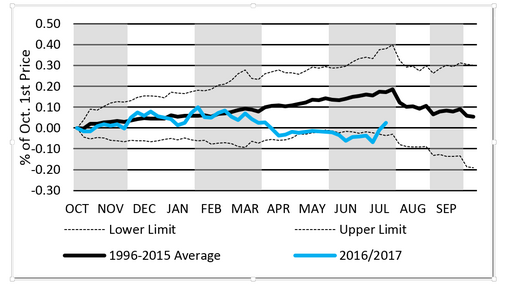

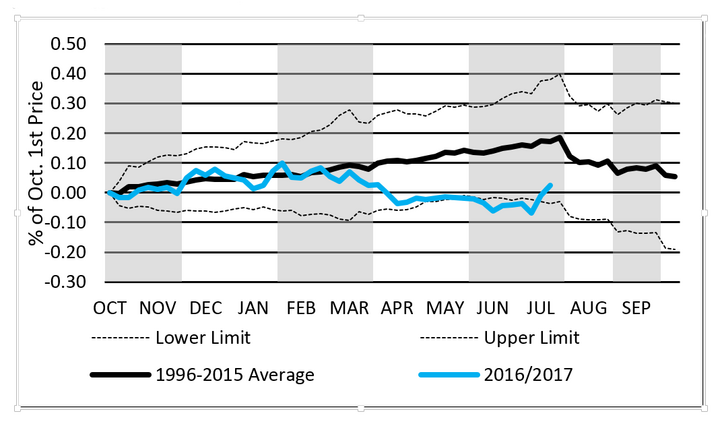

The goal of storing soybeans is to obtain a price higher than was available at harvest. Old crop soybean futures prices closed above the Oct. 1, 2016 price (SX16 $9.73/bu) between Oct. 17, 2016 and March 27, 2017. Recently, prices have returned to levels above those on Oct. 1, 2016. Nevertheless, Figure 1 shows that soybean prices are expected to track downward after the August WASDE report into early fall in anticipation of harvest.

Figure 1 also illustrates the lower and upper limit of historical prices. The range from lower to upper limits increases from the average price (1996-2017) line as time from harvest passes. Those looking to empty bins late this summer are entering a more unpredictable price period.

Traditionally the soybean market does not have large carrying charges. However, 2017 is providing some incentive to store priced soybeans for future delivery. Table 1 shows the most recent differences in soybean contracts between July (SN17) and the next three contracts. All three differed contracts are trading at a premium to July.

Producers with old crop beans in storage may be able to contract beans in the bin for delivery using one of the later contracts. At the time of this article, September (SU17) was offering double the carry to August. Producers with the ability to enter a cash forward or Hedge-to-arrive contract with their local elevator should evaluate whether these price difference are enough to cover the additional storage expense they would accrue.

Based on the expected price trends and carrying charges, farmers not wanting to face a higher level of market uncertainty from the August WASDE should consider pricing their old crop soybeans sooner rather than later.

New Crop Soybean

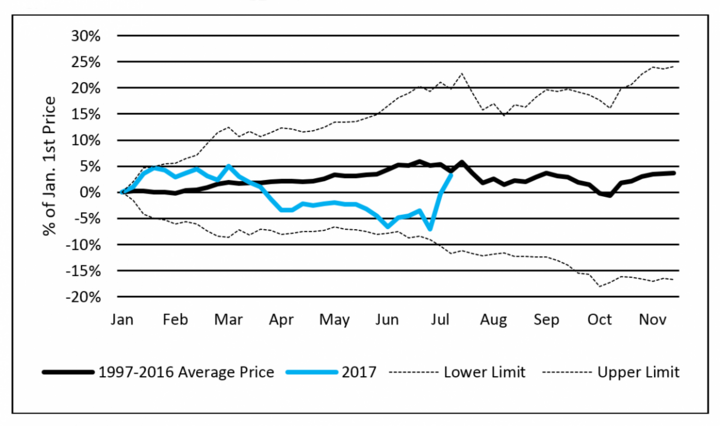

The new crop soybean contract (SX17), has recently improved to levels above the Jan. 1, 2017 futures price (SX17 $9.83/bu.), as shown in Figure 2. Similar to old crop soybean prices, new crop soybean prices are expected to decline and become more unstable after the August WASDE report unless a smaller than expected yield is reported. Farmers expecting to forward contract or hedge should look for opportunities to pre-price new crop soybeans before prices settle into the expected harvest low.

Caution must be given to not oversell pre-harvest bushels (see box). In the end, you must determine the amount of your expected production that you are comfortable pre-harvest pricing. Producers can choose to not pre-harvest price any grain; however, when prices rise to favorable levels, they should consider forward contracting some of their anticipated production to capture these high prices.

It is widely taught that pre-harvest and post-harvest marketing plans for soybeans should be concluded by July 1. However, there may still be some opportunities to reduce your price risk through a carefully planned marketing strategy. Writing down your marketing plan will help you to combat making rash decisions.

Caution

Remember, past performance is not necessarily indicative of future results. Grain marketing involves risk, and you should fully understand those risks before pricing grain.

Managing Risk

Although pre-pricing reduces price risk, farmers are still exposed to yield risk. If more bushels of soybeans are contracted than are produced, a farmer may have to buy bushels from somewhere else to fulfill the contract or pay the grain buyer for the undelivered bushels. Yield risk is partially mitigated by crop insurance, depending on the yield loss. Crop insurance indemnity payments may cover a portion the expense of buying bushels or paying the grain buyer for undelivered bushels.