Farmers know that yield risks vary across the state; however, the ability to compare yield risk between counties is new. Using crop insurance premium calculation data, we can quantify the expected insurance payment (or indemnities) by evaluating the county crop insurance reference rate. Reference rates reflect payments from only historical loss experience. A high reference rate value implies higher historical payments and consequently more production risk and a higher crop insurance premium. Lower reference rates imply lower risk and therefore lower premiums. Reference rates are calculated at the county, crop, and practice (irrigated vs. non-irrigated or summer fallow and continuous crop) level.

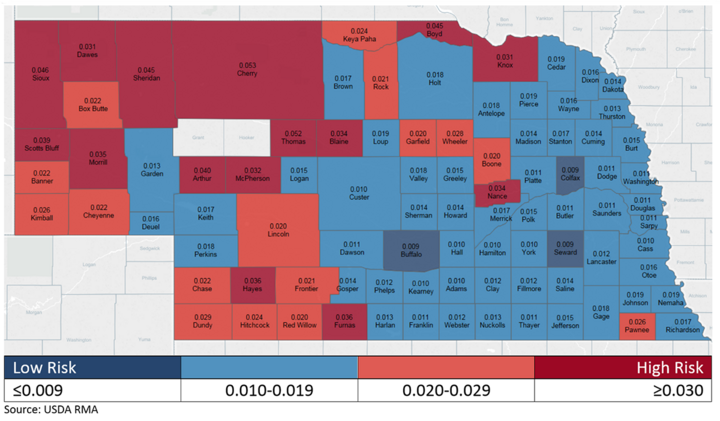

Figure 1 illustrates production risk differences across Nebraska for irrigated corn. Blue indicates reference rates below the statewide average and red indicates rates above the average. Dark blue indicates the lowest level of production risk and dark red indicates the highest level of production risk. Basically, the reference rate indicates the amount of payment for each dollar of liability. For example, if the reference rate is 0.053 (Cherry County), then 5.3% of liability is expected to be paid to farmers.

Figure 1. Irrigated corn production risk based on crop insurance data. (Also see interactive version of this map.)

In examining Figure 1, as expected, irrigated corn production risk is generally lower in eastern Nebraska than in western Nebraska. Buffalo, Colfax, and Seward counties are tied for the lowest production risk (0.009). Cherry County had the highest risk for irrigated corn production (0.053). Production risks can vary drastically from county to county. For example, Garden County came in below the statewide average while three adjoining counties came in above average. Two counties did not have an irrigated corn crop insurance policy: Grant and Hooker.

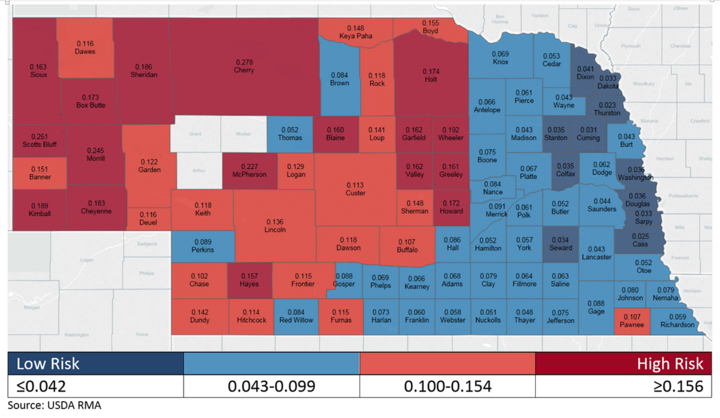

Non-irrigated corn production risk for Nebraska is presented in Figure 2. With a few exceptions the very lowest risk counties are on the eastern Nebraska border. With the exception of a cluster of counties in the north central area (Holt, Garfield, Wheeler, Valley, Greeley, and Howard) and one county in the southeast (Pawnee), the highest risk counties are generally found starting in the central part of the state moving west. Grant, Hooker and Arthur counties do not have a non-irrigated corn insurance policy.

Figure 2. Non-irrigated corn production risk using crop insurance data. (Also see interactive version of this map.)

Interesting conclusions can be drawn from comparing the reference rates of two production practices for the same commodity. Irrigated corn reference rates in Nebraska range from a low of 0.009 to a high of 0.053. This means that the lowest risk irrigated corn producing counties expect a 1% loss (insurance payments) annually, while the highest risk counties expect a 5% loss. Non-irrigated corn reference rates have more than a tenfold difference in production risk, ranging from a low of 0.025 to a high of 0.278. This could be restated to say that non-irrigated corn producing counties experience an annual loss ranging from 2.5% for low risk counties to 27.8% for high risk.

Comparisons between practices can also be made by county. For example irrigation in Cherry County reduces risk by 0.225 from 0.278 (non-irrigated) to 0.053 (irrigated). The impact of irrigation on production depends upon location. For Cass County risk changes by 0.015 from 0.025 (non-irrigated) to 0.010 (irrigated). This suggests that the risk reduction from irrigation depends highly on county weather characteristics.

It is easy for those in a high yield risk county to see the value of crop insurance. However, for counties with relatively low yield risk some may think crop insurance is not valuable. It is important to remember that the premiums in low risk counties will be quite low. Furthermore, when bad outcomes happen in low risk counties, they tend to be large ― recall the 2012 drought. Crop insurance participation is still warranted in these counties, especially a Revenue Protection policy.

From this article we can see that reference rates (county level risks) vary greatly across Nebraska for both irrigated and non-irrigated corn production. These risk differences across the state highlight the need to filter advice from someone not familiar with your risks.

For more information visit the USDA Risk Management Agency.