CARES Act Implications on Tax Planning for Farmers

August 6, 2020

The CARES Act included several other provisions that didn’t get as much attention. Farmers need to be aware of these as they go into tax planning this fall, as they could benefit their operations.

Taking a Closer Look at the Most Efficient Farms

August 7, 2019

The Top Efficient Farms group is a selection of operations with Nebraska Farm Business, Inc that consistently retain more than 20% of gross income as net. These farms are not the highest efficiency farms each year, they are just the most consistent from year-to-year.

Understanding and Applying Casualty Losses

June 3, 2019

Casualty losses are an area of the tax code that we thankfully don’t have to deal with very often. However, when they do occur, they can be a major event in the life of a farming operation. Here are some things to consider and do now before tax time rolls around.

Tax Consequences of Weather-Related Sales

May 31, 2019

How do tax laws apply to crop and livestock losses due to flooding and should they be applied this year? Consider the effects for 2019, 2020 and afterward from using some of these options.

5 Things To Do for Your Year-End Tax Planning

November 28, 2018

2018 was anything but normal with its new tariffs, price declines, and significant tax changes. While you can't control the uncertainties resulting from these changes, you can take steps to understand their effects and adjust your year-end tax planning.

Section 199a of the New Tax Act – The 20% Pass-Through

August 22, 2018

Implementing one of the new tax law changes, Section 199a - the 20% Pass-Through, may offer some challenges to tax preparers working with ag producers who qualify both as business owners and co-op members.

Financial Impact of the Tax Cuts and Jobs Act on Ag Producers

August 22, 2018

As experts continue to interpret the new tax code, two things are certain for ag producers: The changes are far reaching and complex and in many cases, will result in a lower tax liability. This overview looks at several of the major changes affecting ag producers.

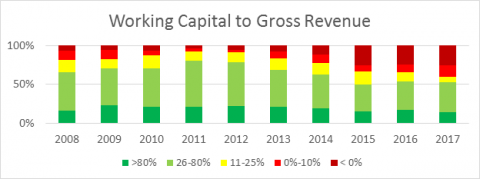

NFBI Averages Show Crop Operations Buoyed Up by Livestock in 2017

May 17, 2018

The 2017 averages from farm and ranch operations serviced by Nebraska Farm Business, Inc. were recently released and show more polarization among healthy and non-healthy financial situations among the group. With the downturn in crop prices, operations that did not adapt are struggling.